“It’s tough to make predictions, especially about the future” – Yogi Berra

Have mortgage rates peaked for this cycle?

Maybe. Nobody really knows. But, it does feel that way, to me. From a high of almost 6% at the end of June, we saw rates move back to the mid 4%s for 30yr fixed loans w/ no points, up through Thursday August 4th, until that blockbuster jobs report. They then pulled back slightly.

Nevertheless, I still think rates may have peaked for this cycle. Having said that, I’ve been wrong a lot more than usual in this unusual year, so you can take my opinions with a grain of salt, just like anyone else’s.

In my defense, I’ve said for years, eventually rates will rise and catch me, and probably most people, by surprise. Well? Surprise! That’s exactly what happened.

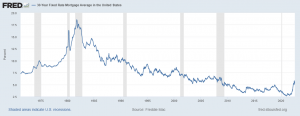

So where do we go from here? This is where we’ve been:

It’s hard to see the recent peak in this 51 year view, so here’s the last twelve months:

As the saying goes, past performance is not indicative of future results. So as I said at the top, who knows where things will go from here?

Either way, it is nice to see what appears, at least for now, as a top in the mortgage rate cycle, since many prognosticators were calling for 30yr fixed rates to be pushing 7% sometime this year. Could they? Sure. Will they? We’ll find out.

We have to remember that the Federal Reserve doesn’t control mortgage rates. They control the Federal Funds Rate, which is an overnight lending rate (ie: very short term).

Mortgage rates are driven by investors, and what they’re willing to accept for their return on investment. Granted, for the last 2+ years (or even long if we go all the way back to 2009 with the first round of Quantitative Easing) the Fed has been the biggest buyer of mortgage backed securities. And, they’re currently allowing those purchases to roll off their books. But, there appears to be enough demand to soak up the extra supply.

For now, that high point for 30 yr fixed mortgage rates around 6% isn’t something we’ve seen a lot of over the last last decade. Whether we’ll see it again, remains to be seen.

Either way, here are my thoughts on why that roughly 6% 30yr fixed mortgage rate may prove to have been the peak in this cycle:

- I think it’s unlikely the Federal Reserve and the FOMC can navigate a “soft landing”. Everyone’s talking about recession. If you use only the definition of two consecutive quarters of negative GDP, we’re already in one. Of course, the National Bureau of Economic Research actually calls recessions, and often w/ a decent time lag. But really, none of that matters. Recessions are a normal part of the economic cycle. So, we will find ourselves in one. When, and to what degree? Those are open questions. My sense is that we’ll be in one, sooner, rather than later.

- The Fed is still very focused on taming the current inflation levels. I doubt they’re done with their interest rate hikes. This is good news for long dated bonds (like 30yr fixed mortgage rates) because inflation is their enemy. Inflation erodes the long-term return investors receive. Right now, it seems the bond markets (including for mortgage backed securities) are feeling that inflationary pressures will recede. That’s at least partly why mortgage rates rallied this week.

- With the unexpectedly strong jobs report from last Friday, more than doubling the number of expected jobs created, and the unemployment rate dropping, and hourly earnings rising, the Fed is likely to feel they have more work to do in slowing the economy.

- The Fed has to create some dry powder in their interest rate game plan so that if/when the economy does soften markedly, they can either halt, or even reverse their current interest rate hikes. As a result, they’re apparently front-loading their increases. In past cycles, they’ve moved the Fed Funds Rate in much smaller increments than they have this year, which has left them little room to maneuver if their projections were off. The risk is, does front-loading rate hikes force us into recession?

- Although the Fed is now allowing their bond portfolio to shrink, with some $95 billion per month not being reinvested into Treasuries and Mortgage Backed Securities, if the economy softens and equities underperform, investors will be more willing to step into that space and help fill the demand void. What rate of return will they want? We’ll find out. But right now, maybe 5% or even 4.5% seems ok to them as a relatively safe place to park cash?

Ultimately, what we’re seeing is the unwinding, or at least partial (or attempt at) unwinding roughly 13 years of unprecedented monetary policy. That’s likely to be bumpy. On top of that, we have plenty of other variables including geopolitical tensions (still no end in sight to the Russia/Ukraine war, Sino-US tensions, to name the two biggies), covidness, etc. and other circumstances we have no way of predicting. But? The world will keep chugging along. There are always myriad factors that blow the economic winds this way or that way.

In real estate, home sellers will adjust to their new reality, as will buyers. It feels right now as if both sides are grappling with their new realities, and many are taking a pause. There are still hundreds of thousands of sales each month, but the mania of the past two years is definitely subsiding.

Here’s your snapshot of where rates started this week. Call or email if you, your family or friends have any questions or would like to discuss refinancing, or buying a home. Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment | ||

| 30 yr fixed mortgage | 4.375% | 1 | 4.425% | $300,000.00 | $ 1,498 | ||

| 15 yr fixed mortgage | 3.875% | 0.5 | 3.925% | $300,000.00 | $ 2,200 | ||

| 5/6 ARM | 4.375% | 1 | 4.625% | $300,000.00 | $ 1,498 | ||

| 7/6 ARM | 4.750% | 1 | 4.800% | $300,000.00 | $ 1,565 | ||

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||||

| 30 yr fixed mortgage | 5.000% | 1 | 5.030% | $1,000,000.00 | $ 5,368 | ||

| 15 yr fixed mortgage | 5.250% | 0.5 | 5.280% | $1,000,000.00 | $ 8,039 | ||

| 5/6 ARM | 5.125% | 0.5 | 5.155% | $1,000,000.00 | $ 5,445 | ||

| 10/6 ARM | 5.375% | 1 | 5.405% | $1,000,000.00 | $ 5,600 | ||

| Rates subject to change without notice. | |||||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (760+ fico, owner occupied SFR with 75% loan to value ratio or less and $200,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||||

Eric Grathwol

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us