Happy Holidays!

I wish the best for you and yours, and hope you’re enjoying yourself this Holiday weekend.

Kind of a wild year in real estate this year, huh? But wait. So were 2020 and 2021. Just in the opposite direction from 2022. Did anyone think those boom times would last forever? That’s the nature of real estate, it seems. Lots of cycles. It’s not really anything we haven’t seen before, and I’ve only been at this for 20 years.

They say history doesn’t repeat, but it can rhyme.

So what will 2023 bring? Who knows? My best guess is things will look a lot like 2022 in the real estate market, as everyone adjusts to our new realities. But the headwinds we saw this year will likely abate a bit, and some new tail winds will begin to blow.

Either way though, there’s still a lot of real estate being bought and sold, regardless of what interest rates and home values do.

Mortgage News Daily provides some good perspective and compiles interesting data. If you look here: https://www.mortgagenewsdaily.com/data/existing-home-sales you can see Existing Home vs. New Home sales data that goes back to 1980 and 1963, respectively.

Some notable decreases in both New and Existing home sales volumes were during the late 1970s and early 1980s, the Great Recession and real estate melt-down circa 2008-2011, and then another dip in 2022.

But, even in those “dark days” of real estate, we still had – and have – significant volume. Looking at the lowest point in recent history, existing home sales bottomed at an annualized rate of 3.8 million or so, and existing homes sold were roughly 287,000. That’s still 4,000,000 homes being sold each year. That’s 330,000 sales per month. That’s a big number.

Granted, real estate is local, so places like Ketchum, Idaho or Pullman, Washington, or Barstow, California may feel different than Boulder, Colorado, Seattle, or Sacramento. But? There’s still homes being bought and sold.

And for the fear mongers out there, even though home values probably will continue sliding lower as we roll into and through 2023, we can never time a market. And, there are much stronger fundamentals than during the Great Recession, that should create a floor in values, sooner rather than later. Back then, lenders allowed investors (or pretend investors) to buy rental properties with zero money down. So, when things got tough, the tough just walked way. That took a while to unwind and find bottom.

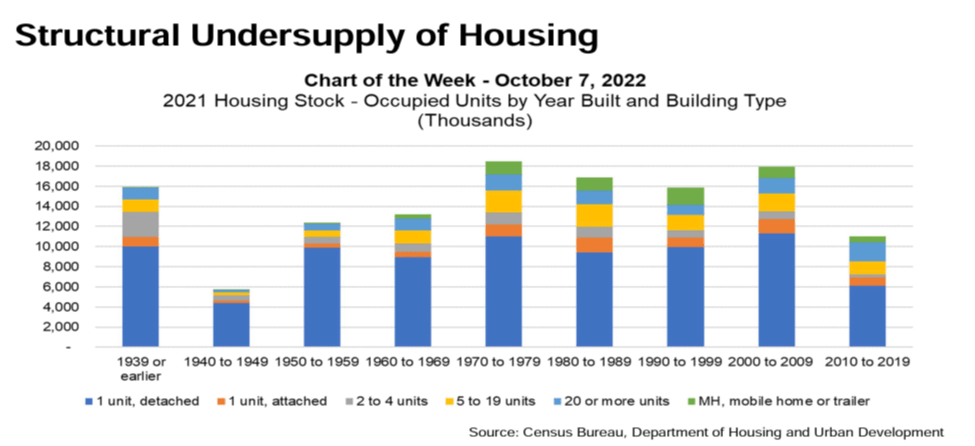

This current down cycle seems more driven by the shock of interest rates rising from their historic floor. But, we still have limited housing supply, relative to demand. That’s likely to keep prices from cratering.

On top of that, most buyers, even those who just recently bought, either have acquired equity, equity from their down payments, and/or have such low interest rates that there shouldn’t be the level of distressed sales we’d need to see, in order to have significant home price declines. Now, significant is relative, so if you bought a home with 10% down, in June of 2022, or even last week, you might see your home’s value decrease to basically match your loan balance over the next year or so. You might even go slightly upside down. But again, as long as your payment is affordable, and you like where you live, are you going to walk away from your down payment? Probably not.

My Uncle, who’s been a real estate attorney for longer than I’ve been alive, told me something a long time ago that still resonates, and I share with all my clients “You buy a house for housing. If you hold it long enough, you’ll usually make money, but not always.” Truer words have rarely been said.

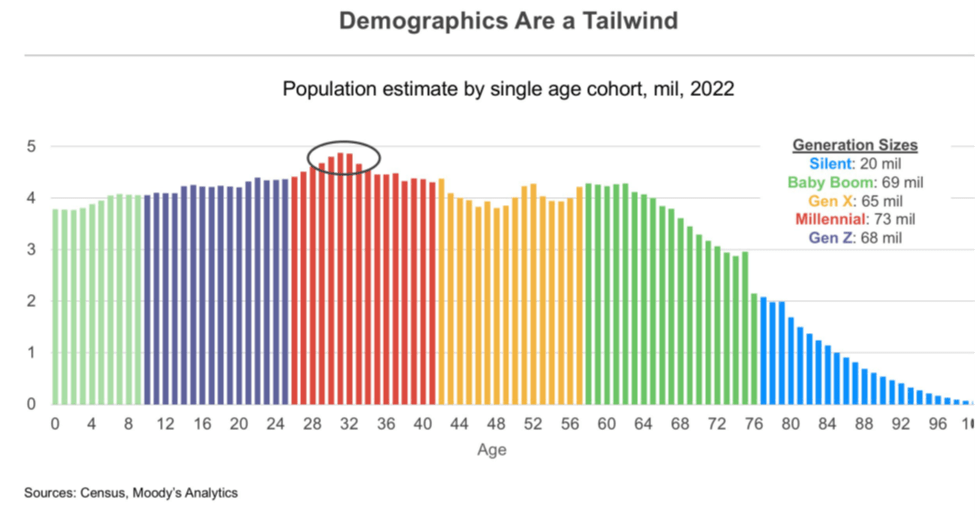

And for the forming tail-winds, that may bolster the real estate market before too long, they’re largely demographic. The Millennial Generation is larger than the Baby Boomers, and they’re just now entering their prime home buying years (late twenties and early 30’s). As we roll through the next decade, and beyond, they’ll be pushing into their prime earning and family raising years, which may create another wave of “move up” buyers, too.

Now, for the other part of the equation, that ties to affordability, along with home prices. I believe interest rates will be headed lower again, sometime in 2023. But, interest rates are relative. Again, reviewing the charts of new and existing home sales, we still had some 3million homes being bought and sold, annually, during the years of 1978-1982 when interest rates were in the double digits. Why? Because you buy a house for housing.

And, for investors, it was a good time to buy too. One of my good friend’s Mom built a decent real estate portfolio in the Santa Cruz area during that time. People thought she was crazy, as she kept buying homes and apartments. But, the math worked for her to cash flow, and then as rates dropped, and values increased, she did very, very well. Retiring twice by the time she was 45 years old. She then transitioned to just managing her real estate portfolio. But, I digress.

Why are interest rates likely to dip again? I think for two primary reasons. I don’t believe the Fed’s rate increases to tame inflation will result in a soft landing, economically. They’ll probably push us into a recession. At that point, short and long term interest rates are likely to drift lower again. Heck, we’re already now back to rates below 6%, which is nearly a full 1% lower than we saw just six weeks ago, and the economy so far seems to be cranking right along.

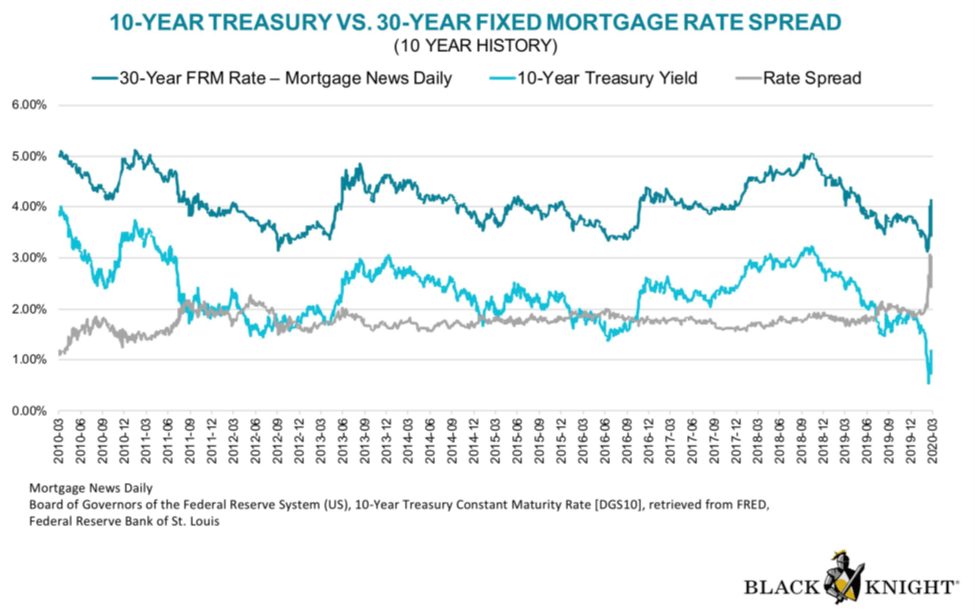

Beyond that, have a look at the relationship between treasury yields and mortgage rates. As I’ve repeated over the years, mortgage rates are set by investors buying mortgage backed securities, and are not directly corelated to any other interest rate. But, there are loose relationships that can be instructive. Looking at the spread between the 10-year US Treasury yield and 30-year fixed rate mortgages, it’s hovered around 1.5% for the better part of the last decade.

This spring, that peaked at about a 3% spread. Today, the 10-year Treasury yield is roughly 3.6% and 30yr fixed mortgage rates are right around 6%, so that’s still about a 2.4% spread. So, if nothing else changes, and the spread between the two reverts closer to it’s average over the last decade, that alone could indicate that mortgage rates may still drop by as much as 1% from current levels.

There’s another saying that you should “marry the house, but rent the mortgage.” And that may prove true again.

If you buy a home now and rates do dip to where you can cost-effectively refinance, you can either shorten your term, and keep your payments where they are. Reset the term, but pay the same as you are now, so you’ll apply more towards your principal balance, effectively shortening your term, while also maintaining the flexibility to pay less if you want to use that money elsewhere. Or, you can take the monthly savings and apply them elsewhere in your life. But, you’ll have choices.

So again, if you believe the premise that you buy a house for housing, then the market swirling and gyrating around that doesn’t really matter. If you find the right home, in the right neighborhood, that meets your needs and budget, the rest will usually come out in the wash. At least if you’re looking at a reasonable time horizon to stay in that home.

And that’s all she wrote.

Wishing you the best for a healthy, happy and prosperous New Year!

Here’s your snapshot of where rates ended this week. Call or email if you, your family or friends have any questions or would like to discuss refinancing, or buying a home. Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment |

| 30 yr fixed mortgage | 5.500% | 1 | 5.550% | $ 300,000.00 | $ 1,703 |

| 15 yr fixed mortgage | 4.875% | 1 | 4.925% | $ 300,000.00 | $ 2,353 |

| 5/6 ARM | 5.750% | 1 | 6.000% | $ 300,000.00 | $ 1,751 |

| 7/6 ARM | 5.875% | 1 | 5.925% | $ 300,000.00 | $ 1,775 |

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||

| 30 yr fixed mortgage | 6.125% | 1 | 6.155% | $1,000,000.00 | $ 6,076 |

| 15 yr fixed mortgage | 6.375% | 1 | 6.405% | $1,000,000.00 | $ 8,643 |

| 5/6 ARM | 6.125% | 1 | 6.155% | $1,000,000.00 | $ 6,076 |

| 10/6 ARM | 6.625% | 1 | 6.655% | $1,000,000.00 | $ 6,403 |

| Rates subject to change without notice. | |||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (760+ fico, owner occupied SFR with 75% loan to value ratio or less and $200,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us