Happy Halloween!

Scared of an interest rate hike? Not sure we need to be.

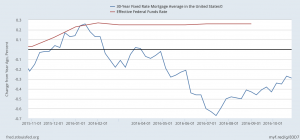

The markets seem to think the Federal Reserve Open Market Committee is going to raise the Federal Funds Rate at their December meeting, like last year. And, they very well may. It seems even the thought of that happening has moved mortgage rates back up to the higher side of this year’s trading range. But, they’re really right where they were in June, when I sent my last update.

And, that’s still only about .25% off the lower side of this year’s trading range. As I pointed out then, we’ve been in a very tight range for quite some time. On the low side, rates are just a sliver above the historic floor set between Oct. 2012 and May 2013. On the high side, they’re not much higher… Still firmly in the “ridiculously low” range.

And, what’s interesting, is that if last year’s Federal Funds Rate hike is any indication, we may see bonds and mortgage backed securities rally, with yields and rates drifting lower again, even if the Fed does increase the short end of the curve. That’s exactly what happened last year.

Of course, there’s the saying that “past performance is not indicative of future results” when it comes to investments like bonds, mortgage backed securities, equities (and many other things) so we really have no idea what may or may not happen, IF the FOMC does in fact raise rates in December.

But, from my perspective although the economy is growing, it’s happening pretty slowly. And, a lot of the “usual” metrics economists use to gauge economic progress are throwing off mixed signals.

On the bright side, the economy has continued its longest run of job growth in history. And, we saw today, that the preliminary Q3 GDP reading came in at 2.9%, which is pretty good, relative to where we’ve been recently.

But, just to point out a couple of the potential clouds on the horizon, although job growth has been pretty strong, wage growth has remained subdued, as has personal spending. And, although 2.9% GDP in Q3 looks ok on the surface, the details may point to some contributions that may not continue.

As Janet Yellen, Chair of the Federal Reserve System, said at a conference organized by the Federal Reserve Bank of Boston on Oct. 14, 2016 “Extreme economic events have often challenged existing views of how the economy works and exposed shortcomings in the collective knowledge of economists.”

We’re very much in uncharted territory, from a variety of perspectives. Heck, if really smart economists are puzzled, how are the rest of us supposed to know anything with certainty?

We’re not. We just have to keep making it up as we go along. The world will go on. The view may look a little different, but, the sun always rises.

We’ve been in a very low interest rate environment for almost a decade now. And, again, that’s been a 30+yr process to get to this point. Japan? They’ve been in an ultra-low interest rate environment for almost 30 years now. Will the US be the same? I’m not convinced of that.

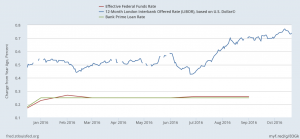

One interesting new development is on the shorter end of the interest rate curve. As one would expect, since the Federal Funds Rate is a short term rate, other short term rates seem to be moving in the same direction as the Federal Funds Rate.

The Prime Rate, which drives home equity lines of credit and credit card rates generally mirrors moves to the Fed Funds Rate, and is on the rise accordingly.

The LIBOR (the London Interbank Offered Rate) on the other hand, began rising last year, prior to the FOMC raising the target Fed Funds Rate. That’s important, because most Adjustable Rate Mortgages are based on the LIBOR. Since then, it’s risen at a faster clip:

As you’ll see in the chart below, the Federal Funds Rate sits at a target of .5%. Prime is 3% higher, at 3.5%, and the 12-month LIBOR is at 1.5% or so:

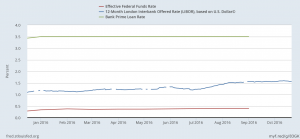

What that means to you, is that if you have a Home Equity Line of credit, your rate is rising with each move to the Federal Funds Rate, by the same increment. Your actual interest rate is based on the Prime Rate, plus your Margin (whatever the bank is charging you over Prime). If you’re at Prime + 0%, you’re now paying 3.5%, up from 3.25% last year. If you’re at Prime + 1.5%, you’re paying 5%, up from 4.75% last year.

Similarly, if you have an Adjustable Rate Mortgage, it’s very likely based on the LIBOR (other indices are used for ARM’s, but in general all those short term rates are beginning to rise, as well). A typical margin over your ARM index is 2.25%. So, if your loan is set to adjust in the next few months, you may be looking at 1.5% LIBOR index value, plus 2.25% margin, so it’ll recast based on 3.75%, over whatever term you have remaining. That’s still a great rate. But, if you can secure fixed financing, at a lower interest rate, it may be worth looking into doing so.

And, although the LIBOR is not directly tied to the Federal Funds Rate (whereas Prime does mirror the Fed Funds Rate) if the Fed Funds rate increases in December, it’s very likely the LIBOR will continue creeping up, as it has been. And, right now, in many cases, you can secure fixed financing than you may be paying on an ARM if it’s in the adjustment period.

And, that ties into a whole other conversation entirely, which is the inverted yield curve. That’s when short term rates are higher than long-term rates. That’s often a harbinger of an impending recession. Even without that, we’ve seen this economic expansion run for about seven years now, which is a very, very long expansionary cycle. As a result, many people already fear a recession may be around the corner.

What’s the Federal Market Open Market Committee going to do in that event? Maybe we’ll see. Maybe we won’t.

I’ll do my best to keep you posted as we continue muddling through. In the meantime, I hope you’re enjoying the ride.

Please don’t hesitate to call or email if you, your friends, clients, or family have questions about buying or refinancing residential or commercial real estate.

Here’s how our rates ended this week.

Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment |

| 30 yr fixed mortgage | 3.375% | 0 | 3.425% | $ 300,000.00 | $ 1,326 |

| 15 yr fixed mortgage | 2.750% | 0 | 2.800% | $ 300,000.00 | $ 2,036 |

| 3/1 ARM | 3.875% | 0 | 3.925% | $ 300,000.00 | $ 1,411 |

| 5/1 ARM | 3.000% | 0 | 3.050% | $ 300,000.00 | $ 1,265 |

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||

| 30 yr fixed mortgage | 3.875% | 0 | 3.905% | $ 550,000.00 | $ 2,586 |

| 15 yr fixed mortgage | 3.500% | 0 | 3.530% | $ 550,000.00 | $ 3,932 |

| 3/1 ARM | 3.875% | 0 | 3.905% | $ 550,000.00 | $ 2,586 |

| 5/1 ARM | 3.500% | 0 | 3.530% | $ 550,000.00 | $ 2,470 |

| Rates subject to change without notice. | |||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (760+ fico, owner occupied SFR with 75% loan to value ratio or less and $250,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||

Eric Grathwol

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us