Well? They did it again. Last week, the Federal Open Market Committee voted to increase the Federal Funds Rate, much to the surprise of practically no one.

What may have surprised you was that mortgage backed securities, which determine mortgage rates, and US Treasuries rallied on the news, driving rates and yields, lower. Most people who don’t follow this stuff every day were expecting mortgage rates to rise with another increase in the Federal Funds Rate.

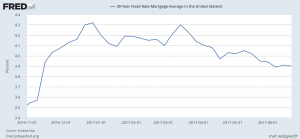

But, mortgage rates are currently hovering slightly above where we were prior to the Presidential Election. We’re essentially at the lowest point since Nov. 8th, which puts us within striking distance of their prior floor. Again.

As always, where rates will go from here is anyone’s guess. But, I won’t be surprised to see mortgage rates lower later this year than they are now.

As always, where rates will go from here is anyone’s guess. But, I won’t be surprised to see mortgage rates lower later this year than they are now.

We’re seeing the ongoing tug-o-war between equities, which are making new record highs, while bonds are still kicking and screaming, at the lower end of their historic range, that there may be another economic story unfolding vs. the “all’s right in the world” version that equities seem to be selling.

Had anyone told me, as the Great Recession crushed markets in 2008-2009, that we’d be nearly a decade out, and still see 30 year fixed mortgage rates below 4%, I don’t think I’d have bought it.

If someone said to me today, that we’ll still see 30yr mortgage rates around 4% in another eight or ten years, I don’t think I’d believe that, either. But, clearly, that doesn’t mean it can’t, or won’t happen.

Maybe we’re more like Japan than we think. They’re what, 30+ years beyond their great market meltdown, they have unemployment at around 2.5%, and? They are still contending with (or fighting with) historically low interest rates, with limited economic growth, in terms of GDP.

It certainly continues to be interesting times. Since we never know what the future holds, we’d better make the most of what we have now, including ridiculously low mortgage rates. Where they’ll go from here, is anyone’s guess.

I’ll do my best to keep you posted as we roll on through this year, and beyond. Please don’t hesitate to call or email if you, your friends, clients, or family have questions about buying or refinancing residential or commercial real estate.

Here’s where rates are as of today.

Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment |

| 30 yr fixed mortgage | 3.750% | 0 | 3.800% | $ 300,000.00 | $ 1,389 |

| 15 yr fixed mortgage | 3.125% | 0 | 3.175% | $ 300,000.00 | $ 2,090 |

| 3/1 ARM | 4.500% | 0.5 | 4.750% | $ 300,000.00 | $ 1,520 |

| 5/1 ARM | 3.125% | 0 | 3.175% | $ 300,000.00 | $ 1,285 |

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||

| 30 yr fixed mortgage | 4.000% | 0 | 4.030% | $ 550,000.00 | $ 2,626 |

| 15 yr fixed mortgage | 3.625% | 0 | 3.655% | $ 550,000.00 | $ 3,966 |

| 3/1 ARM | 4.625% | 0 | 4.655% | $ 550,000.00 | $ 2,828 |

| 5/1 ARM | 3.625% | 0 | 3.655% | $ 550,000.00 | $ 2,508 |

| Rates subject to change without notice. | |||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (760+ fico, owner occupied SFR with 75% loan to value ratio or less and $250,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||

Eric Grathwol

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us