January 2, 2022

Happy New Year!

I hope that however 2021 was for you and yours, 2022 brings more health, happiness, and prosperity.

This is my first missive since March 14, 2020, when the mortgage market nearly froze, and the Fed subsequently unloaded both of their monetary bazookas of lowering the federal funds rate to near zero (0% to .25% target rate from 1% to 1.25%) and stepping back into the mortgage backed security and treasury markets, buying hundreds of billions of dollars of each, basically becoming the market, again.

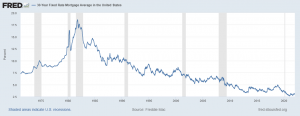

Two years ago, prior to the pandemic, the average 30yr fixed rate was roughly 3.8%. As Covidness hit and the global economic system basically shut down for a time, rates dove to their lowest point in history, bottoming about a year ago, and have remained in stupid low territory since (stupid low is an economic term I, think).

We’re currently sitting about .25% to .5% off that historic floor, depending on the scenario, but that’s still markedly lower than rates of January 2020. A mere two years ago. So, where will rates go from here?

Most people think they will go higher. And we hope they do, as that would mean a normalizing economy, putting Covidness further and further behind us and general improvement across the board. But, people say rates will go higher, pretty much every year. However, I’m not convinced we’ll see rates at much higher levels ending 2022 than they are starting the year.

As I’ve pointed out numerous times, we’ve been in a declining interest rate environment for basically as long as they’ve been tracking 30yr fixed rates, starting in 1971, except for a brief period from the end of the 1970s into the early 1980’s. And, at least 60% of the time, rates have ended the year lower, than where they entered. Whether that happens again, is anyone’s guess.

But in the meantime, you can just look at that chart, see when you got your mortgage, and have a sense of whether you can get a lower rate now, and by approximately how much. Heck, if you got your loan in 2018, just three or four years ago, and have never refinanced it, chances are, you can cost-effectively refinance now and save at least 1% on your rate. Even if you got your loan in 2019 or early 2020 prior to March, you can probably save .5% to 1% with a no points, no fees refi. That can add up to real money back in your pocket, vs. lining some bank or investors’ pockets. Or, you can use those savings to shorten your term, paying your mortgage down or off at a much faster pace, without necessarily impacting your cash flow.

So why do I think rates may not rise that much this year? We’ve been living off unprecedented monetary policy basically since The Great Recession, which was doubled down upon during the height of the Covid Pandemic. We don’t know what it’s like to live without it anymore.

Nevertheless, right now, we’re seeing the Federal Reserve trying to unwind this extreme monetary support, tapering their asset purchases and discussing raising the federal funds rate sooner, rather than later.

How that’s going to impact our economy is not clear. Is there enough economic stability and demand to suck up their increasing slack? That remains to be seen.

But, at least we’re getting back into more interesting times, in terms of interest rates and where they may be headed from here. That’s one of the reasons I’ve not written anything in so long. I found it hard to say anything too helpful and informative, other than “rates are at stupid/historically low levels, and take advantage of that opportunity while you can.” That may remain the case throughout this year too, but at least there will be more signposts to try to gauge what’s happening, and why. As always, I’ll do my best to keep you posted.

On a personal note, you probably got my calendar magnet, and may have wondered, who are these old dudes and why are they on here? If so, you’re not alone. I’ve been sending those for about 15 years now. I think the only other time I’ve gotten so many questions and comments about the picture was when we had our dogs on there. I usually try to infuse my personality in my work, and that magnet is no exception. So, that’s my Dad, and his octogenarian friends, former dorm roommates, from their freshman year at Providence College. My Dad’s the guy in the yellow shirt. He’s dealing with Alzheimer’s, and is in great spirits and can be present in the moment, but that was possibly a last hurrah for him and his friends at one of their daughter’s (the fifth buddy who couldn’t make it due to a conflicting family reunion) wineries in Maryland. My siblings and I were there to share the day, and it was awesome.

I hope you and yours are able to find some awesomeness in things from time to time too. But, back to interest rates, they are still awesomely low. So, get ‘em while you can!

Here’s where rates ended last week. Call or email if you, your family or friends have any questions or would like to discuss refinancing, or buying a home. Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment | ||

| 30 yr fixed mortgage | 2.875% | -0.5 | 2.925% | $300,000.00 | $ 1,245 | ||

| 15 yr fixed mortgage | 2.125% | -0.5 | 2.175% | $300,000.00 | $ 1,948 | ||

| 5/1 ARM | 2.875% | 0 | 3.125% | $300,000.00 | $ 1,245 | ||

| 7/1 ARM | 2.875% | 0 | 2.925% | $300,000.00 | $ 1,245 | ||

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||||

| 30 yr fixed mortgage | 3.500% | 0 | 3.530% | $555,000.00 | $ 2,492 | ||

| 15 yr fixed mortgage | 3.500% | 0 | 3.530% | $555,000.00 | $ 3,968 | ||

| 5/1 ARM | 2.875% | 0 | 2.905% | $555,000.00 | $ 2,303 | ||

| 10/1 ARM | 3.250% | – | 3.280% | $555,000.00 | $ 2,415 | ||

| Rates subject to change without notice. | |||||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (760+ fico, owner occupied SFR with 75% loan to value ratio or less and $200,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||||

Eric Grathwol

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us