I hope the Holidays are most excellent for you and yours.

In my last update from September, I wrote about what’s “normal” with mortgage rates? 30 year fixed mortgage rates were hovering around 7% – where they’ve been, basically, for most of the year – and that now seems pretty normal.

Although they’re back a bit below 7% now, after having a brief brush in the high 7%s earlier this fall, for practical purposes, they’re in the same general range. Still. But, the point I continue making is that normal is relative.

So what about the housing market? What’s normal there? Again, it’s all relative.

Real estate is always local, so it’s important to understand the dynamics in your specific market (or even neighborhood within that market) including average days on the market for a listed home, and most importantly, the relationship between list price to contract/sales price for recent sales of similar homes to what you’re buying, or selling.

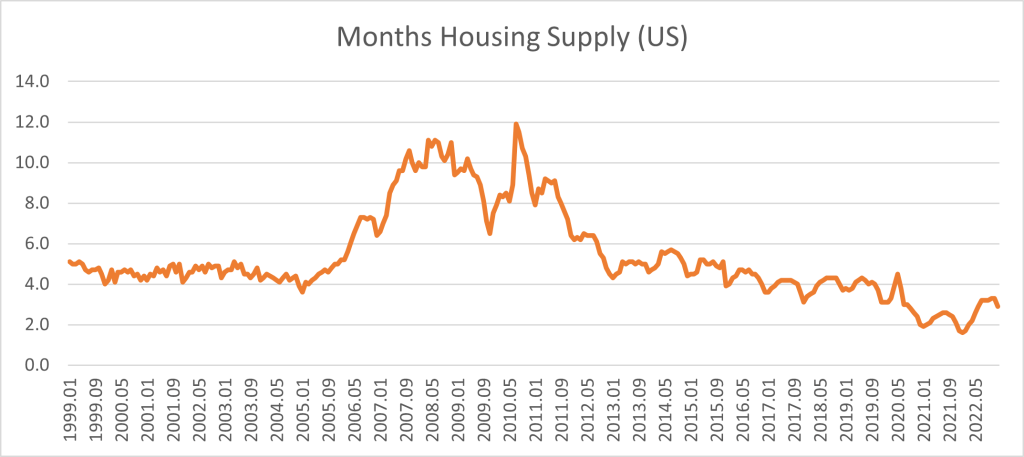

In most cases, a “balanced market” is perceived as having about four to six months’ supply of available homes. But, take a look at this chart comprised of data from the National Association of Realtors:

Based on their data, the US housing market was in balance between 1999 and 2005, and again between roughly 2013 and the spring of 2020. For the other periods between spring 2006 and summer 2013 and again from the spring of 2020 through to 2022 – and even through today – the months of housing supply has been out of balance, as either buyers or sellers markets.

Including nearly 25 years since NAR has been keeping these statistics, at least on a national level, the housing market has been “in balance” just a little over half that time. So what’s normal?

For about seven years, between 2006 through to 2013, it was skewed towards a buyer’s market. That was normal then. Since early 2020 we’ve been stuck in a seller’s market. That’s normal now.

The market you’re in, is what’s normal. Right now, that’s still a seller’s market. And, that may not shift much in the near term, simply due to supply and demand. But, does it matter? I say not really.

You buy a house for housing. If it fits your needs and budget, and is more cost-effective than renting, you buy if you can afford to buy. For real estate investors, you buy to hold and rent with an eye towards long-term cash flow and/or appreciation, or to flip in the near to medium term, looking to sell for a relatively quick profit.

In my personal real estate journey, I bought my first home in 1998 in the foothills outside Sacramento. Interest rates were in the 7% range, which was normal for that time (and it’s normal now too). The market where I bought was likely in balance, based on extrapolating from data that I’ve found, but the home, its features and amenities and the location worked for me. In fact, I’m still there! And it’s almost paid off.

My first rental, I bought in the fall of 2006. Oops. Remember what happened next? Yeah. It was worth about half what I paid for it a few years later, and probably took at least a decade more, to get back to what I paid for it. Nevertheless, the cash flow was sufficient to cover my mortgage, and although I fed it consistently for repairs/maintenance and vacancies, I was fortunate that that wasn’t a burden. It’s now worth about two and a half times what I paid for it, and it’s basically paid off, too.

Towards the end of 2009 I bought a house in Tahoe. That timing was more fortuitous (thanks Matt!) as that was pretty close to the bottom of the market correction from the real estate meltdown of 2008/2009 – probably a little ahead of the bottom. That home has appreciated significantly since then as well.

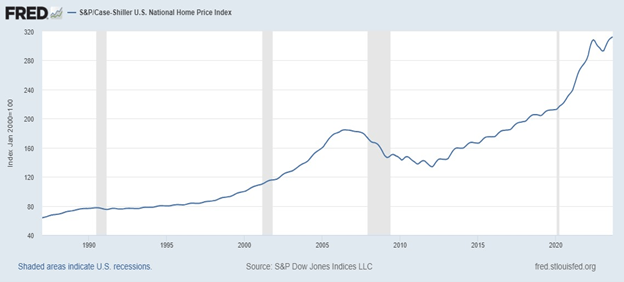

I’m a buy and hold guy. If you have a long-term horizon, owning real estate is probably going to work out nicely for you. By almost any measure, home prices have never been higher than they are now. Here’s the S&P Case-Shiller Price index:

If you buy a home today might it be worth less than you paid for it in a year or two or even five? It’s definitely possible. Particularly with home values currently sitting at all-time highs.

But if there’s one thing we know nearly for certain, it’s that over time, it’s more likely that that home will appreciate and be worth more than you paid for it, than less. Plus, you’ll have paid down your loan balance.

Additionally, with the current tailwinds of limited supply, and still stable demand, a great reduction in home prices doesn’t seem that likely. And, if there is a significant drop in prices, due to increased inventory or other factors, that’s likely to free pent-up demand, pulling more buyers in from the sidelines. Which in turn may bring the market into balance, rather than skewing it into a buyers’ market.

Similarly, if interest rates continue drifting lower, that would seem to further bolster buyer demand, even if it brings in more sellers who are less reticent to stay “locked in” to their historically low interest rate, and ultimately decide to sell and buy anyway.

Meanwhile, although it seems that the economy will roll over into a recession at some point, although that may bring interest rates down, if people are nervous about their income and assets, they may be less likely to buy a home. So demand dips, which may again buoy home prices a bit.

Having said all that, speaking about existing homes, the dynamic may be changing with some new homes. I am starting to see and hear about new home builders (the large, national builders, at least) doing some crazy things, as seller incentives, to unload their “near move-in ready” homes, aka standing inventory, or near-standing inventory. IE: homes that were in contract, built, and then the buyers either bailed, or could no longer qualify. Builders don’t like sitting on them for long, so they do whatever’s needed to unload them, basically.

Could that be the tip of the iceberg of a changing market dynamic? I doubt it. New home sales make up a relatively small percentage of total home sales (around 20%, on average). Plus, you can’t stop building existing homes. They exist. New home builders will just slow construction, or in some cases halt entirely, until the tide turns back in their favor.

And that ties back into the overall supply/demand story. New home construction is unlikely to ever fill the void between available housing stock, and the demand for housing. Something else has to give, to create a more balanced supply to meet demand.

I recently saw a thoughtful piece about housing and the challenges of affordability, by Richmond Federal Reserve Bank President, Tom Barkin. He was speaking at the 2023 Virginia Governor’s Housing Conference. You can find it here, if you’re interested: https://www.richmondfed.org/press_room/speeches/thomas_i_barkin/2023/barkin_speech_20231115

Addressing access to, and the affordability of housing is going to continue as a pressing matter. And like most things, there isn’t one solution. It’s a difficult and layered conundrum that will take multipronged and likely pretty creative solutions that will take years, if not decades to fully manifest.

In the meantime, markets for homes and mortgage rates to finance them will gyrate. Ultimately, that shouldn’t be your primary motivating factor.

You buy when it’s right for you, based on your specific scenario and finances. If it’s the right home, in the right neighborhood, that fits your needs and budget, odds are, everything else will come out in the wash. Whereas, the best “deal” on home prices (or ridiculous builder/seller incentives) or the lowest available interest rates don’t do you a lick of good, if it’s the wrong house, in the wrong neighborhood. Let the house that can be home drive the bus. You’ll know when you find it.

With that, here’s your snapshot of where rates ended this week. Call or email if you, your family or friends have any questions or would like to discuss refinancing, or buying a home. Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment | ||

| 30 yr fixed mortgage | 6.625% | 0.125 | 6.675% | $ 300,000.00 | $ 1,921 | ||

| 15 yr fixed mortgage | 6.375% | 0.375 | 6.425% | $ 300,000.00 | $ 2,593 | ||

| 5/6 ARM | 6.000% | 3.75 | 6.250% | $ 300,000.00 | $ 1,799 | ||

| 7/6 ARM | 6.000% | 4.375 | 6.325% | $ 300,000.00 | $ 1,799 | ||

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||||

| 30 yr fixed mortgage | 6.625% | 0.5 | 6.655% | $ 1,200,000.00 | $ 7,684 | ||

| 15 yr fixed mortgage | 7.500% | 0.5 | 7.670% | $ 1,200,000.00 | $ 11,124 | ||

| 5/6 ARM | 7.125% | 0.75 | 7.379% | $ 1,200,000.00 | $ 8,085 | ||

| 10/6 ARM | 7.500% | 0.75 | 7.745% | $ 1,200,000.00 | $ 8,391 | ||

| Rates subject to change without notice. | |||||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (780+ fico, owner occupied SFR with 75% loan to value ratio or less and $200,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||||

Eric Grathwol

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us