Who wants a 30yr fixed mortgage in the high 4%s or low 5%s?! Anyone looking to buy a home, is the right answer. That’s where the market is, currently.

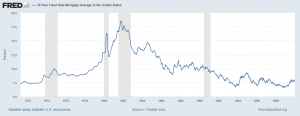

Of course, for refinances, there are always going to be life circumstances that make whatever the prevailing rate is look attractive (vs. just lowering your rate, payment and/or shorting the term, as has been so common for the last decade). It’s just this recent spike is pretty unprecedented, approaching a 2% increase in just three or four months, surpassed only by the surge in rates from spring into summer, 1980.

But really, 5% 30yr fixed money is still good, from a historic perspective. It’s basically just back to where we were in late 2018, and early 2011 through late 2010 before that. And from 2009-2010 and earlier? A 5% 30yr fixed rate had been basically inconceivable. It had never happened before, other than in a brief window during 2009. We’ve just been spoiled, since then.

So what’s happening now?

It’s all about inflation. First we had the supply chain disruptions, and that’s been compounded by the Russian invasion of Ukraine. If you’re lending money out at 3% or whatever, and inflation is at 7%, you’re taking a beating, over time. We’ve all seen the price of gas, and headlines about seeing the highest inflation in 40 years. Interest rates have risen accordingly.

But are we really looking at an inflationary period like we saw from the mid- to late 1970s through the early 1980s that pushes mortgage rates into the double digits, or even high single digits? I’m not convinced.

I think this may be another spike in rates that proves to be way over blown and temporary, with bonds and mortgage backed securities proving to be in way oversold positions. I won’t be surprised if in 12-18 months, the markets are more worried about deflationary pressures than the inflationary ones that are fueling this run up. I may be the only person on the planet who thinks that, and I could definitely be wrong, but that’s my opinion now. And although we’ve been saying for at least 20 years “rates have to go up, sooner or later” every upward move has always proven temporary. I’m not sure this time will be different. There’s a saying that history doesn’t repeat, but it does rhyme.

This is what forms my opinion. Right now, we’re seeing the biggest increases in food and energy costs, but also in other areas – like things needing microchips, which is a lot of stuff these days (phones, cars, computers, appliances, etc.) that we’ve seen in a lifetime. Food and energy, people have to consume. That squeezes out funds from their budget that they may otherwise spend elsewhere. For the consumer discretionary stuff being squeezed by higher prices? Well, people can just put off those types of purchases, in many cases.

So if your budget’s being squeezed by costs of basic necessities, and you pull back on consumption (both for those necessities, and optional expenses) what happens? Demand destruction. If there’s less demand, pricing pressures ease, and may reverse if demand slackens for long enough.

Then you have the war on Ukraine. There are many layers to that conflict, and I don’t see it ending any time soon. Hopefully I’m wrong, but I don’t see how Putin “takes on off ramp” without somehow manufacturing a victory. Is that by annexing the Donbas region and calling it a “win”? Maybe, but I doubt it. And whether Zolenskiy and the Ukrainians would allow that, is another question. And, however that war ends, I don’t see an end to the sanctions against Putin, his oligarchs, and thus the Russian people, being unwound quickly, either.

Although together the Ukrainian and Russian economies are a small percentage of global GDP (because most of GDP is consumption based), they are significant producers of goods that other countries consume (wheat, and energy, oil, natural gas, coal, etc.). The OECD (Organization for Economic Cooperation and Development) projects the war could reduce global GDP by 1% while pushing consumer inflation higher by 2% (https://www.oecd-ilibrary.org/sites/4181d61b-en/index.html?itemId=/content/publication/4181d61b-en).

IHS Markit comes to a similar conclusion, that global GDP may contract by .8%, and inflationary pressures could push higher by 2.5% (https://ihsmarkit.com/research-analysis/russias-war-ukraine-reshapes-geopolitical-economic-outlook.html).

Another factor is that the US and global economies have been expanding at a nice clip for a while, so at some point, that expansive cycle was going to run its course, with or without the shocks of higher inflation and interest rates.

So, back to the point that history doesn’t repeat, but it does rhyme. Looking at this chart of mortgage rates since January 1, 2000, we can see several spikes of roughly 1% within similarly short periods of time.

Each time we’ve seen an interest rate spike in the last twenty-two years, it’s been followed by either a gradual or sharp move down again. Could this time be different? Sure. But I’ll believe it when I see it.

And, if you’re saying “well, we’re in for some crazy, long-lasting inflation, like we saw in the 70’s and 80s” so what about that? Here’s the chart for 30yr fixed mortgage rates covering that span from 1971 through December 1999:

The patterns don’t necessarily repeat, but they do seem to rhyme. Each move higher was followed by either a sharp drop, or slowly drifting lower, over time. So the question to me is, where is equilibrium? Will we ever know it if we see it?

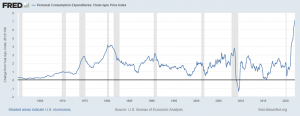

The Fed seems to consider a 2% inflation target (based on the personal consumption expenditures index) consistent with price stability and long-term growth. We’re clearly running hotter than that now. But for how long? What happens when the impact of the pandemic and the Russian-Ukrainian war subside?

Looking at the PCE index, the inflationary pressures we’re seeing now seem to be an extreme outlier, including the period most people consider to be of the US’ hyper-inflation of the late 70s and early 80’s.

Many economists are starting to focus further back than the inflationary spike of the 70s and 80s, looking more towards the aftermath of WWII.

In some respects, that’s more similar to what we’re experiencing now. During the war, supply chains were shifted to produce materiel for the war. Workers – historically men – were off fighting the war. Citizens were encouraged to ration, so pent up demand was high (sound familiar?). Some believe that the normalization of those factors, combined with market forces, subdued inflation without massive monetary intervention.

Will this time be different? We’ll find out.

And, speaking of WWII, we also have to consider demographics. The ongoing retirement of Baby Boomers, the largest generation to move through the US, and many countries’, labor force in history, is not an inflation supporting event. And, we’re in the early stages to mid-stages or watching that phenomenon unfold.

I finished my last update at the new year with “rates are still extremely low, so get ‘em while you can!” They were still in the 3% range at that time. I sure didn’t see this spike coming, however. But I’m betting they won’t remain at current levels for too long. Whether that’s a few months or a year or two, we’ll find out.

For those reasons, I think this recent spike in inflationary pressures, and the ensuing march higher for interest rates will prove temporary.

But ultimately, none of that matters. If you’re buying a home, you’re taking the pricing the market’s giving. You can’t control interest rates, so there’s no point worrying about them. You buy a primary residence for housing. You buy an investment property either because it cash flows, you hope to gain from appreciation, or both. A good friend of mine’s Mom bought a lot of rentals during the late 1970s and early 1980s, when interest rates were at their zenith. People thought she was crazy. She retired twice by the time she was 45, spending about ten hours a week managing her rental portfolio.

If you’re refinancing, unless you’re still sleeping on a 5.5% to 6% rate from the 2000s or so, which millions of people still are, then you’re considering doing so for other reasons, and it either serves that purpose cost-effectively for you, or it doesn’t.

Here’s your snapshot of where rates started this week. Call or email if you, your family or friends have any questions or would like to discuss refinancing, or buying a home. Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment | ||

| 30 yr fixed mortgage | 4.875% | -0.5 | 4.925% | $300,000.00 | $ 1,588 | ||

| 15 yr fixed mortgage | 4.125% | -0.5 | 4.175% | $300,000.00 | $ 2,238 | ||

| 5/6 ARM | 4.875% | 0 | 5.125% | $300,000.00 | $ 1,588 | ||

| 7/6 ARM | 5.000% | 0 | 5.050% | $300,000.00 | $ 1,610 | ||

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||||

| 30 yr fixed mortgage | 4.375% | 0.5 | 4.405% | $1,000,000.00 | $ 4,993 | ||

| 15 yr fixed mortgage | 4.500% | 0.5 | 4.530% | $1,000,000.00 | $ 7,650 | ||

| 5/6 ARM | 3.875% | 0.5 | 3.905% | $1,000,000.00 | $ 4,702 | ||

| 10/1 ARM | 4.250% | 0.5 | 4.280% | $1,000,000.00 | $ 4,919 | ||

| Rates subject to change without notice. | |||||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (760+ fico, owner occupied SFR with 75% loan to value ratio or less and $200,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||||

Eric Grathwol

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us