Happy Holidays! I hope the season is treating you and yours well.

In this letter, in addition to a quick – or what I hope is a quick – recap of this year’s mortgage market movement, and my take on what things may look like as we roll into the New Year, I’m going to touch on a relatively new mortgage program for home renovation loans, that’s really cool. It’s unlike anything offered before.

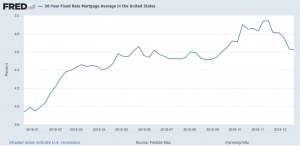

But first, this year was another interesting one in the mortgage market. In my newsletter from January of this year, I pointed out that since the early 1970’s, basically 2/3rds of the time, mortgage rates were lower leaving the year, than they’d entered it. Well? That’s not likely, this time. We’re set up to be in that 30% of the time where rates left the year higher than they entered.

Going into 2019, it looks like the average 30yr fixed mortgage rate will be about .625% higher than it was coming into 2018.

But, where will be in another 12 months is anyone’s guess. We do know that a recession’s coming. We just have no clear idea of when. Nor do we know whether any downturn will be relatively minor, or of a more severe variety, and what that may do to markets for equities, bonds and mortgage backed securities.

What we can point to is that rates are still really low, from a historic perspective. We’re only about 1%-1.25% higher than the floor we saw between Oct. 2012 and May 2013, which we’ve nearly hit a few times since.

Do I see us getting back to those lows any time soon? No. And, it’s possible we’ll never see rates that low again. But, there are certainly circumstances that could see the equities slide further, pulling treasury yields and mortgage rates lower, while driving those security prices higher.

From my view, 2019 is likely to look a lot like 2018 in terms of volatility. But, the overall economic picture may not be as strong. We may have hit the cycle low in unemployment. And, that may roll over just as we start to see a little wage pressure. It appears the benefit of the recent tax cuts, may have run their course, meanwhile there’s concern over the ongoing budget deficits and national debt ( and whether we’ll be able to grow ourselves out of those problems, remains to be seen).

If you look at the DOW Industrial Average in 2018, it’s been gyrating around 25,000. Meanwhile, the 10yr treasury yield – a reasonable proxy for 30 yr mortgage rate movement – has been hovering around 3%. And, 30yr fixed mortgage rates have been bouncing around 4.625%, on average. And, as we’ve seen, the swings around and within those ranges can be pretty severe and sudden.

To me, the bigger question is whether the same general range will hold, or whether we’ll shift to some higher plateau for equities, yields and mortgage rates, or if things will soften, to a lower level for those three components.

Equities have been on a good run, really since the election of Donald Trump. And, treasuries and mortgage backed securities have suffered. Was that a sugar high, of sorts, in equities, that we’re now seeing wear off?

Ultimately, equities, bonds and mortgage backed securities are all competing for the same investment dollars. And, on the treasury and mortgage backed security side of the ledger, with the US Federal Reserve unwinding its balance sheet, basically on “auto-pilot” per Fed Chairman Jay Powell (albeit some FOMC members have begun rephrasing that) the additional supply is significant. Yet, so far, the demand seems to be there to soak up that additional supply, especially during the last month or so. Meanwhile, other central banks around the globe may be starting to retract some of their liquidity too, as everyone strives to normalize their balance sheets, ahead of any future downturn.

And, if the US economy does roll into and through a soft patch, or into an outright recession, will we find ourselves with the DOW down another 20% or so, back closer to 20,000, where we started 2017? And if so, will that pull treasury yields and mortgage rates down too? After all, it was right then, when we last saw mortgage rates around for 30yr fixed loans, consistently below 4% with no points.

Or? Is this just another blip of a correction, and the economy will pick up another bit of steam and churn to a new, higher plateau, driving treasury yields and mortgage rates higher with them?

As always, it will be interesting to watch it unfold, and I’ll do my best to keep you posted.

In terms of the new Renovation/Rehab loan that’s available that I mentioned starting this note, it’s the Fannie Mae Homestyle Renovation Loan. The most unique features are:

- The home does not need to be livable. That’s huge. Until now, a home had to be habitable in the first place, to use a rehab loan to buy it. That’s no longer the case.

- Owner occupants can buy a home, and finance their construction with as little 3% down.

- It can be used for accessory units, if permitted by your zoning (most rehab loans previously wouldn’t allow you to implement “luxury” features, per se).

- This loan is eligible for non-owner occupants/investors, too. It’s not designed for flippers, but more for buy and hold investors.

- You can also use it to refinance and remodel/rehab an existing home (although if you’re at one of the historically low interest rates already, there may be better options for you, but it’s worth discussing).

For buyers, it’s still hard to find the right fit. But, it seems that in some places the market is beginning to turn, so sellers with properties in need of rehab are having to sit on them for longer than even just a few months ago. Additionally, cash buyers may be more reluctant to buy, because it feels like we “might” be closer to the top of the appreciation cycle, than we’ve been in a long time. So, the confluence of factors that might allow this type of loan to work for you, or someone you know, are more likely.

As always, if you, your family or friends have questions about this loan program, mortgage rates, or any other real estate financing, I hope you won’t hesitate to reach out. My best wishes to you and yours for a happy, healthy and prosperous New Year.

Here’s where rates are as of this weekend (interestingly, they’re pretty much where they were three months ago, as well as about nine months ago; I may have mentioned something about trading in a relatively tight range this year).

Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment | |

| 30 yr fixed mortgage | 4.375% | 0 | 4.425% | $ 300,000.00 | $ 1,498 | |

| 15 yr fixed mortgage | 3.875% | 0 | 3.925% | $ 300,000.00 | $ 2,200 | |

| 5/1 ARM | 3.875% | 0 | 4.125% | $ 300,000.00 | $ 1,411 | |

| 10/1 ARM | 4.375% | 0 | 4.425% | $ 300,000.00 | $ 1,498 | |

| Jumbo (ask me about Super Conforming limit, per your zip code) | ||||||

| 30 yr fixed mortgage | 4.625% | 0 | 4.655% | $ 550,000.00 | $ 2,828 | |

| 15 yr fixed mortgage | 4.500% | 0 | 4.530% | $ 550,000.00 | $ 4,207 | |

| 5/1 ARM | 4.625% | 0 | 4.655% | $ 550,000.00 | $ 2,828 | |

| 10/1 ARM | 4.625% | 0 | 4.655% | $ 550,000.00 | $ 2,828 | |

| Rates subject to change without notice. | ||||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (760+ fico, owner occupied SFR with 75% loan to value ratio or less and $250,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | ||||||