I sometimes wonder if I’ve been brainwashed.

When I got into the mortgage business, 15 years ago, when people asked what I was thinking, I used to joke that I liked the challenge of getting into something right before rates started back up again. At that time, interest rates for 30 year fixed mortgages were dipping below 6%, down from about 7% the year prior, and we all thought those were low.

Now? Now we think 4.5% or 5% is high.

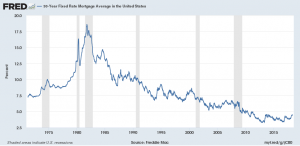

And, that brings me back to the brainwashing. You’ve seen me post this chart many times. It’s a snapshot of prevailing 30yr fixed mortgage rates since they’ve been tracking them, starting in 1971:

Basically, since 1981, when I was 11 years old, interest rates have been declining. Yes, we’ve seen periods of rising rates within that larger trend, but the overall trend was nevertheless lower.

Now, we’re at what “might” be, finally, another inflection point. Maybe, just maybe, we’ll see that rates are on the rise, never to look back and turn lower again. I’m just not sure I buy it.

That could be a result of my life long, and certainly career-long, brainwashing. Or, maybe we’re not quite “there” yet?

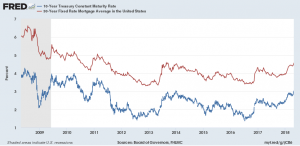

Here’s a look at both the average 10yr treasury yield, and mortgage rates for the last 10 years:

Again, prior to the market meltdown, we had 30yr fixed mortgage rates in the 6%s. We know the history of the last decade. They eventually bottomed between Oct. 2012 and May 2013, when then Federal Reserve Chairman Ben Bernanke said, and I’ll paraphrase “look people, at some point this extreme monetary policy will need to normalize”. The markets freaked out.

We saw a nearly 1% spike in rates, in what is now called the “taper tantrum” as markets feared that without the Fed’s massive bond-buying program who would support that market? 30yr fixed mortgages shot up from roughly 3.5% to 4.5% in June of 2013, and the yield on the 10yr US Treasury hit 3%. Both moves, however, proved temporary. The markets calmed themselves, and rates drifted lower again for the remainder of the year.

Until December 2013, when the Federal Reserve Open Market Committee announced their plans to actually begin curtailing their bond and mortgage backed security purchases. The tapering would begin in earnest in January of 2014. Again, the 10yr Treasury yield hit 3% and again, mortgage rates spiked alongside them.

Only to drift lower again. By January of 2015, just one year later, rates had rested down to within a fraction of the prior floor, established in late 2012 and early 2013.

But again, they were not done trying to break higher. The economic skies appeared to be finally clearing. Real estate was appreciating in most markets at a rapid clip. Job creation was solid. Consumer spending was growing. Inflation was nowhere to be found (at least statistically speaking). The market was absorbing the demand for treasuries and mortgage backed securities, despite the Fed’s curtailed purchases. By the middle of 2015, mortgage rates were back above 4%. Was this finally liftoff?

Not so fast.

By the middle of 2016, rates had again bottomed out at about that same historically low level we’d now seen twice before.

Then came the election of President Trump. That was interesting. The market futures went crazy – in a bad way – and it looked like mortgage rates may plummet as the down tanked. Only the opposite happened the following day. Mortgage rates spiked from about 3.5% to 4.25% or so, basically overnight, and there was a rally in equities.

Maybe the pro-business policies of the Trump Administration would spur faster economic growth, and finally get interest rates off the floor?

Again, not so fast.

By springtime 2017, mortgage rates were again drifting lower. By September, they were back down in the 3.75% to 3.875% range. Where would they go from there?

So far? Higher. In December of last year, they again climbed the up escalator, and, so far, have not stepped off.

However, they’ve again seemed to stall out at what appears to be a key 3% mark on the 10yr Treasury Yield, and about 4.5% for a no-points 30yr fixed mortgage.

Now, if only I could see the future, I’d tell you what will happen next, from my beach-side or slope-side perch, with my favorite beverage in hand. Instead, all I – or any of us can do – is read the tea leaves, and make some guesses. Hopefully somewhat informed and educated guesses, but guesses nevertheless.

So, here’s some of what I see in those tea leaves on the “rates may only rise” side:

- Our economy is on pretty good footing, with unemployment at cycle lows, relatively high consumer confidence, and relatively strong consumer spending.

- We have never seen fiscal stimulus this late in an economic expansion, that could lead to continued growth.

- Perhaps the corporate tax cuts will improve earnings, driving stocks higher at the expense of bonds and mortgage backed securities, since most of what sets mortgage rates is supply and demand driven.

- Perhaps people will use their tax cuts to ramp up spending, driving demand, and thus prices – and inflation – higher. Inflation is the nemesis of bonds and mortgage backed securities, so rates may move higher in response.

- With the Fed backing off their bond-buying program, and the tax cuts, alongside increased Government spending, bond issuance is increasing to fund liabilities and the market may demand higher rates of return to purchase our debt.

- We’ve been in a 40-year declining interest rate environment. That has to end sometime, right? Right?!

As to the other side of those tea leaves that “rates may dip again” here’s some of what I see:

- We’re now into the 2nd longest economic expansion in recorded US history. If this expansion carries on through this year, it will be the longest economic expansion in recorded US history. How long can that continue?

- The rise in consumer spending – which comprises 70% of our economic growth – has been driven by increased use of credit; people maxing out credit cards, cashing in equity gained in their homes with refinances, etc. It’s not organic growth, it’s borrowed growth. Have we seen this movie before?

- What if consumers use their tax savings to pay down debt instead of to fuel increased consumption? What if corporations use their windfall to buy back stock, or grant executive bonuses, vs. increasing their labor force and raising wages permanently?

- Although the unemployment rate is at a cycle low, that often portends a recession isn’t far behind. And, currently, although job creation is still moving at a decent clip, average jobs created each month have actually been on a decline for a couple years now.

- If any of the geopolitical hot spots flare, or if a trade war really does break out between the US and China (which I don’t think it will, our economies seem too intertwined for that to benefit either side) that could throw a wrench into the economic engine, as well.

- We’re only now beginning to see the economic impact of the first increases in the short end of the yield curve that the Federal Reserve is engineering. Will they be able to facilitate a smooth transition, or will their actions have more unintended consequences?

Of course, there are myriad other points one can make for either side of that equation. Those are just a few things that could drive our economic future, and thus interest rates, as we move through this year.

It’s been an interesting 15 years. I’m still not sure if I’m brainwashed, or not. I’ve thought on at least a few of the recent interest rate spikes we’ve seen, “this is it, we’re finally going to have escape velocity, and rates are going to rise, and never look back”. So far, that hasn’t been the case. Will this time be different, or is this just another head fake?

We’ll see.

In the meantime, please don’t hesitate to call or email if you, your friends, clients, or family have questions about buying or refinancing residential or commercial real estate.

Here’s where rates are as of this weekend.

Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment | |

| 30 yr fixed mortgage | 4.500% | 0 | 4.550% | $ 300,000.00 | $ 1,520 | |

| 15 yr fixed mortgage | 4.250% | 0 | 4.300% | $ 300,000.00 | $ 2,257 | |

| 5/1 ARM | 4.125% | 0 | 4.375% | $ 300,000.00 | $ 1,454 | |

| 10/1 ARM | 4.250% | 0 | 4.300% | $ 300,000.00 | $ 1,476 | |

| Jumbo (ask me about Super Conforming limit, per your zip code) | ||||||

| 30 yr fixed mortgage | 4.875% | 0 | 4.905% | $ 550,000.00 | $ 2,911 | |

| 15 yr fixed mortgage | 4.750% | 0 | 4.780% | $ 550,000.00 | $ 4,278 | |

| 5/1 ARM | 4.500% | 0 | 4.530% | $ 550,000.00 | $ 2,787 | |

| 10/1/ ARM | 4.875% | 0 | 4.905% | $ 550,000.00 | $ 2,911 | |

| Rates subject to change without notice. | ||||||