II hope the Holiday Season is treating you and yours well.

When do you think mortgage interest rates will go down?

That’s one of the more common questions I get. The answer? They already have.

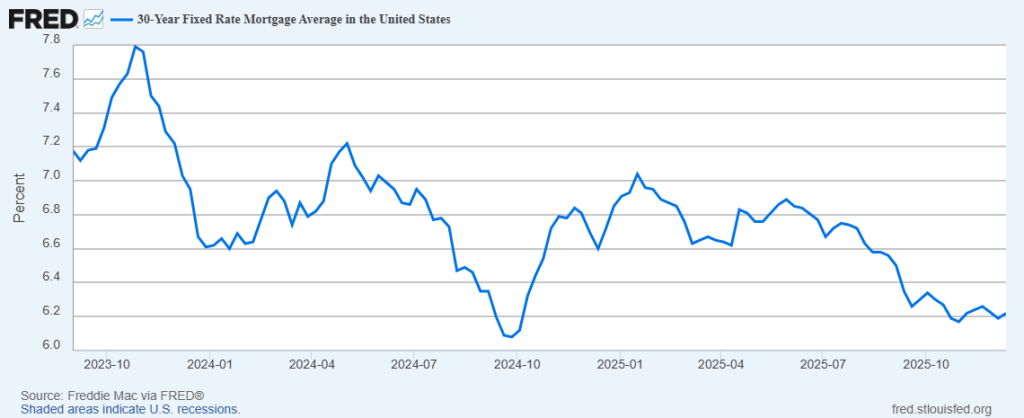

As you can see, the recent high point for 30yr fixed mortgages was between September and October 2023 with rates in the mid- to high 7%s, on average. Now we’re sitting in the mid- to low 6%s. That’s a significant decrease.

How much lower mortgage rates will go from here is anyone’s guess. Most people, myself included, don’t see any significantly lower rates on the horizon, barring any crazy unforeseen shocks to the economy.

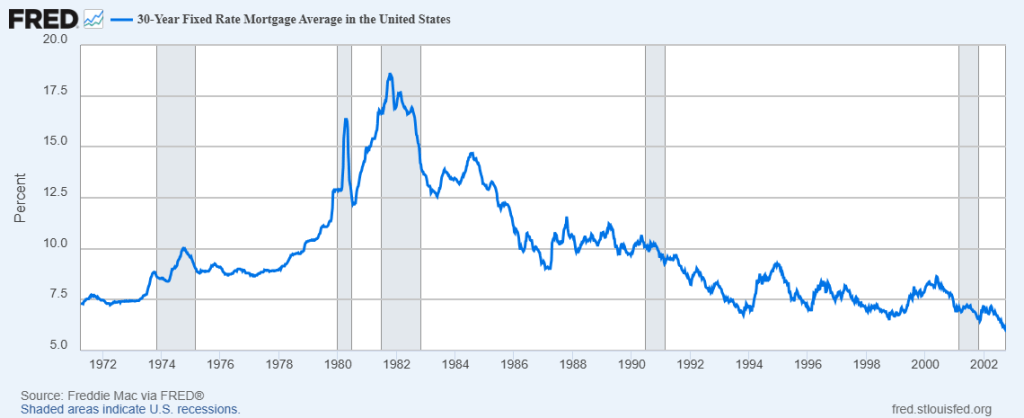

Did you know that prior to September of 2002, 30yr fixed mortgage rates had never been below 6%? That means that for about 50 years, nobody had ever seen a 30 year fixed mortgage rate below 6%. Sounds unreal, right? But it’s not. And that was a low point prompted by the bursting dot-com bubble and economic fallout. Then it took almost another ten years for rates to break below the 5% threshold in the wake of the Global Financial Crisis. This graph only covers from 1971 forward, but prior to 1971 mortgage rates had never hit 6% either. Crazy, huh?

But what’s crazier, is that there’s still so much disbelief that mortgage rates might remain in this current range for years. If not decades. It’s entirely possible.

It’s also possible that they will drift a bit lower. I tend to think they will. By how much? Again, my best guess is that 30yr fixed rates will settle somewhere in the 5%s. When and where, exactly? Who knows?!

Do I think we’ll see a 4% 30yr fixed rate again? I don’t think it’s very likely. I am not expecting that in my lifetime (unless you want to pay a lot to buy down to that level).

Lower interest rates are generally a function of bad economic times. In some cases, really bad economic times. That’s why the dot-com bust preceded interest rates falling. That’s why after the Global Financial Crisis of 2008-2009, interest rates again moved to unprecedented lows. Then finding a lower floor during the pandemic of 2020, depressing rates to levels we’d never seen before, and in my belief are unlikely to see again.

That’s why it’s important to remember who sets mortgage rates.

It’s not the Federal Reserve. It’s not banks, per se, that lend you the money. It’s investors. You’ve heard me say that for over 20 years now.

Large investors buy into pools of mortgage backed securities (MBS) to park their funds and get a relatively low-risk return on their money, while maintaining reasonable liquidity. We’re not talking about investors like you or me, we’re talking about investors like governmental agencies (including the Federal Reserve, at least since the Global Financial Crisis) or CalPERS, and multi-national corporations (including banks like Chase, BofA or Goldman Sachs), along with governments, including China.

They look at their world of investment choices and use MBS as part of their investment mix. In that vein, MBS are akin to bonds. You can buy 10-year Treasury Bonds, which currently pay a yield of about 4.1% depending on the day, or you can buy into pools of mortgage backed securities, which might pay you in the 6% to 6.5% range. With US Treasuries, there is essentially zero risk, if you believe in the full faith and credit of the United States. With MBS, there is some default risk, but you get a higher rate of return, as a result.

So why would mortgage rates move lower than current levels? It will only happen if other investments that deliver higher returns, but carry more risk, start under performing, or outright tanking. Then those investors may pull their funds, and place them into generally safer investments with more stable returns. As money flows into pools of MBS, their price goes up, but their yield – rate of return – goes down. And mortgage rates will follow.

Is that likely in 2026 or 2027? My base case, which I’d call maybe a 60%-70% chance of happening, is that the economy will continue performing about as it has been, meaning steady, but low growth, employment/unemployment will plateau, and inflationary pressures won’t pick up significantly.

Within that construct, it’s possible that we’ll see mortgage rates settle down a bit from current levels. Not so much due to economic activity, or lack thereof, but more due to the narrowing of the spread between the yield on the 10-year Treasury, and mortgage backed securities. That’s been quite a bit larger (about 2% to 2.5%) than the historic norm (closer to 1.5%) for some time now. That compression could bring mortgage rates down another notch.

But I’m just a simple caveman mortgage broker with some opinions.

Here’s what some experts have to say:

Mike Fratantoni, the Chief Economist at the Mortgage Bankers Association thinks mortgage rates “(will) stay within a fairly narrow range over the next few years,” an outcome that “becomes more likely as the Fed reaches the end of their cutting cycle next year.” (Scottsman Guide, Dec. 11, 2025).

Michael Wolf, Global Economist and Senior Manager at Deloitte has this as his base case: “Despite the slowdown in consumer spending, business investment remains strong as companies continue to pour money into AI-related investments. Even with the headwinds expected next year, real business investment is expected to grow by 3% before accelerating to 4.4% in 2028. Even so, real gross domestic product is expected to slow to 1.4% in 2026 from 1.8% in 2025. Growth is then expected to rebound above 2% in 2027 before slipping back below 2% through 2030.” (Deloitte US Economic Forecast) This again points to a low growth, but not stagnant nor shrinking economy, with relatively mild inflationary pressures.

According to Chen Zhao, head of economic research at Redfin, “A weaker labor market will lead the Fed to cut interest rates in 2026 and bring monetary policy to a more neutral place, which should keep mortgage rates in the low-6% range. But lingering inflation risk and the likelihood that we’ll avoid a recession will keep the Fed from cutting more than the markets have already priced in. That’s why rates may dip below 6% occasionally, but not for any meaningful period. The Fed will change leadership in 2026, but that is also unlikely to bring significantly lower mortgage rates, as long term rates–like mortgage rates–are set by bond markets.” (Redfin News, December 2, 2025)

Lawrence Yun, Chief Economist at the National Association of Realtors also feels 6% is about where mortgage rates will be in 2026 (NAR Forecast Summit, December 10, 2025).

Fannie Mae’s economics team forecasts 2026 will see rates in the 6% range, with a possible dip into the high 5%s (5.9%) in 2027 (Fannie Mae Housing Forecast, November 2025).

And lastly, although the Federal Reserve Open Market Committee doesn’t set mortgage rates, we saw from their meeting this week, Chair Powell’s ensuing press conference, and the subsequent speeches by members of the FOMC, that they too are unclear on the economic path going forward, and whether further economic softening and lower inflation is in the cards, or not. There were significantly varying opinions of how they should manage monetary policy as we roll into 2026. Without a doubt, it will help to see more of the government data that had been sidelined during the government shutdown. But uncertainty remains high.

Of course, everyone making forecasts can be woefully wrong. Not only could we just be misreading the tea leaves, or peering through our muddy crystal ball, but there are always potential unforeseen events that can drastically shift the direction of the US and/or global economies. And that’s why I stick to my “base case” of about 60%-70% odds that 2026 will see mortgage rates drift a little lower than present levels, with some dips providing cost-effective refinance opportunities for those who are ready to seize them. Meanwhile, there’s maybe a 15%-20% chance that the economic wheels fall off, disinflation sets in, and mortgage rates move lower than I anticipate. Or another 15%-20% chance of the opposite. That the economy keeps chugging along, stronger than expected, inflationary pressures remain elevated, and mortgage rates push back a bit higher.

Either way, ultimately, it’s important to realize that in general, the only way we’re going to see significantly lower mortgage rates than we have now are 1) if the spread between the yield on the 10yr Treasury narrows, which is almost entirely up to those investors in MBS pools, or 2) if we head into bad economic conditions, where the economy falters, other asset classes tumble, and the flow of funds moves heavily into the relative save haven of bonds and mortgage backed securities, bringing yields down with them.

Low rates are generally a result of bad economic times. And, honestly, nobody should really want that. Even though it does generally work out well for being a simple caveman mortgage broker.

We’ll see how it all shakes down. As always, I’ll do my best to keep you posted on where things are, and my take on what direction they may be headed, and why.

In the meantime, if you or anyone you know would like to discuss any specific scenarios for buying or refinancing a home, feel free to call, text or email me, any time. I’m always happy to be a resource. You know I’ll tell you my thoughts and help you dig into the math, whether it’s what you want to hear, or not.

With that, here’s your snapshot of where rates ended this week. Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment | ||

| 30 yr fixed mortgage | 6.000% | 0 | 6.050% | $ 300,000.00 | $ 1,799 | ||

| 15 yr fixed mortgage | 5.750% | 0 | 5.800% | $ 300,000.00 | $ 2,491 | ||

| 30 Yr fixed FHA mtg | 5.875% | 0 | 6.725% | $ 300,000.00 | $ 1,775 | ||

| 30 Yr fixed VA mtg | 5.990% | 0 | 6.420% | $ 300,000.00 | $ 1,797 | ||

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||||

| 30 yr fixed mortgage | 5.875% | 1 | 6.051% | $1,200,000.00 | $ 7,098 | ||

| 15 yr fixed mortgage | 5.500% | 1 | 5.738% | $1,200,000.00 | $ 9,805 | ||

| 5/6 ARM | 5.375% | 1 | 5.638% | $1,200,000.00 | $ 6,720 | ||

| 10/6 ARM | 5.750% | 1 | 5.891% | $1,200,000.00 | $ 7,003 | ||

| Rates subject to change without notice. | |||||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (780+ fico, owner occupied SFR with 75% loan to value ratio or less and $200,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||||

Eric Grathwol

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us