Well? We put the first quarter of 2025 in the books. Is it me, or does each year seem to fly by faster and faster?

I was talking with a client recently (actually a guy I helped buy their first home nearly 20 years ago, speaking of time flying) and asked him “what do you want to hear about in my newsletters beyond the normal interest rate analysis?” He suggested maybe some information on how to make money in real estate. Good idea! There are obvious ways, and also some less obvious ways you may not have considered.

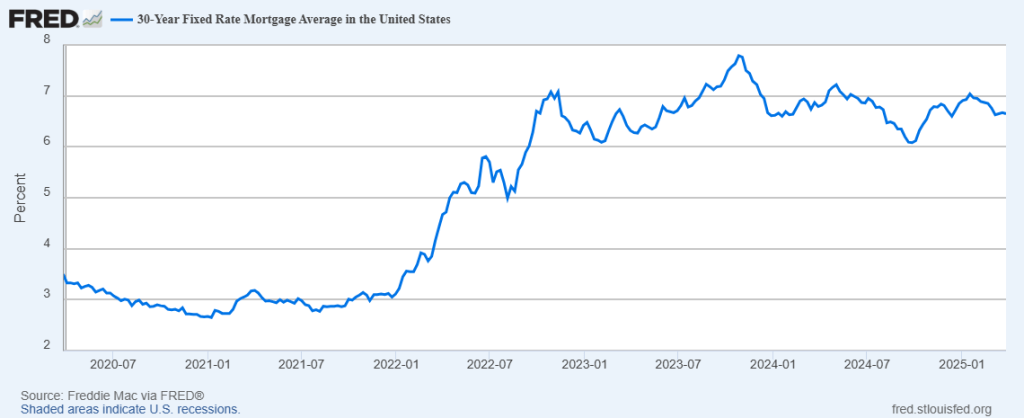

But first, the obligatory interest rate snapshot and my take on where they may be headed and why – at least briefly. My base case is that we’re going to see mostly flat rate movement this year, with 30 yr fixed rates maintaining a floor around 6.5%, without paying a lot to buy down to a lower rate, or sliding higher for a large lender credit.

That’s basically where we are now. And, as you can see from the graph above, it’s pretty much the same range we’ve been in since rates rose from those historic lows in the spring of 2022. By September 2022, they’d crested 6% and haven’t moved lower since. That’s almost three years of basically being range bound, for anyone who’s counting. We got close to that 6% level for a brief window in early 2023, and again for two weeks, just prior to the Fed’s cut to the Federal Funds Rate in September 2024, and that’s it.

There will most likely be peaks and valleys within this range, but that’s the range that I think holds. Those windows of opportunity can open and close quickly. If you bought your home when rates were higher, and were ready and positioned to catch any of those dips over the last few years, good for you! If not? They’ll probably be more in the future. When? Who knows?!

That’s my base case. I’d put maybe 60% odds on that 6.5%-ish range holding, with maybe a 20% chance something breaks, and rates move a little lower (maybe we slide into a recession without inflation remaining sticky), or about the same 20% chance that factors force rates a bit higher than present levels (like if inflation perks up forcefully again).

What about how to make money in real estate? If you don’t own a home, that’s one place to start. You buy a home for housing. Generally, that will work out over the long run as a reasonable investment, as well. Not always, but generally. Particularly if you have a long enough ownership horizon.

Some people like buying a duplex, triplex or quad, living in one unit and renting the others. That’s a good way to subsidize your ownership costs. Did you know you can now buy an owner occupied multi-unit home (2-4 units) with conventional financing and as little as 5% down? You used to have to use FHA financing to put as little as 3.5% down, or you had to have at least 15% down for conventional financing on 2-4 unit owner occupied properties.

That notwithstanding, investing in real estate involves risk. I can probably teach a seminar on how to make money in real estate. I can also probably teach one on how to lose money in real estate. Almost anyone and everyone who invests in real estate has lost money at times, too. HGTV only shows the winners. I don’t know anyone who’s hit a home run every time. If it were that easy, everyone would do it.

Other obvious methods include buying a property that generates sufficient cash flow to cover your ownership costs, and spin off additional positive income. Another obvious method is to buy distressed homes, fix and flip them. Those are active methods of real estate investing. They may be obvious, but they’re not necessarily easy.

For passive investing, you can buy into REITs (Real Estate Investment Trusts), or DST (Delaware Statutory Trust) deals. DST deals require that you’re an accredited investor.

You can do Trust Deed investing.

You can join your local real estate investment group to learn from other investors’ successes, and failures and gain knowledge and experience you can apply as you see fit. I sponsor NorCalREIA (www.norcalreia.com) as one option.

I was speaking with another client who sold his home and rental properties in the Sacramento area about 8-10 years ago, and moved to Indianapolis. His investing partner is still in CA. They now own 20 properties, all in Indianapolis. Their money went a lot further there. The couple who moved to Indianapolis have recently started living the “van life”. They work for Real Wealth (www.realwealth.com) as the people who travel the country, investigate interesting markets, vet, and build their team of local professionals for people’s more passive investing.

I have some clients who have found they’re able to buy homes in Detroit for anywhere from $5,000 to $20,000, rehab them, generate a value of ten times their investment, and either flip them for profit or hold for rental income.

There’s also property wholesaling or using seller financing to get your deals done.

But, did you know you can buy a primary residence for an elderly parent or disabled child, where you don’t have to live in that home? As long as your parent or disabled child makes it their primary residence, that allows you to benefit from owner occupied financing terms. You will have to document that your parents or disabled child cannot qualify on their own, but that’s typically not difficult. You benefit by using primary residence down payment and financing terms, instead of paying the investment property or second home pricing premiums. That can be powerful.

I’m 54. My Dad just turned 86, and is deep in the Alzheimer’s journey. Fortunately, he and his wife bought into a graduated care facility about ten years ago while they were both fully functioning and living independently, so he’s all set as his needs have changed. But, for many, caring for an aging parent is a very real issue. And a huge financial burden.

If your parents are unable to qualify on their own, and you have the financial wherewithal, you can buy a home to house them, and benefit from owner occupied loan programs, even if you’re not living there. Since elder care homes can cost anywhere from $5,000-$15,000 or more per month, this may be an effective alternative for some. And, you can even buy the house next door to yours (or down the street)! There are no distance requirements.

Similarly, if you have a child who has a disability or special needs that would preclude them from earning enough money to buy their own home, you can purchase one for them as their primary residence. Again, benefitting from the owner occupied vs. non-owner-occupied financing terms.

Or, if your child or children are not disabled but are going to college, you can be a non-occupying co-borrower with them, provided they have at least the minimum required credit history and scores, but they don’t need to have any qualifying income. If you’d like some insight into how you can best help your kids establish good credit, without the risk of them over using or abusing it, give me a call.

You benefit from primary residence financing, instead of buying it with the investment property down payment and interest rates. Meanwhile, their friends can then pay you rent as roommates. That may be more cost-effective than paying rent for four years (or in my case six years.) And, college towns often make good investment opportunities due to having a relatively captive market. I wish my parents were able to do that while I was in Boulder!

And lastly, ADU’s. Accessory Dwelling Units. They’re all the rage, particularly in places like California where inventory is so limited in many places. Did you know you can do a rehab loan to finance the construction of an ADU?

The bottom line is, there are myriad ways to invest in real estate. There’s also a lot of hucksters and snake oil salesmen profiting off the unsuspecting. You have to do your research, be diligent, triple check your math, and work with people you like and trust. Even then, success is not guaranteed.

If you’d like to discuss any specific scenarios, feel free to call, text or email me, any time. I’m always happy to be a sounding board. You know I’ll tell you my thoughts and help you dig into the math, whether it’s what you want to hear, or not.

With that, here’s your snapshot of where rates started this week. Call or email if you, your family or friends have any questions or would like to discuss refinancing, or buying a home. Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment | ||

| 30 yr fixed mortgage | 6.500% | 0 | 6.550% | $ 300,000.00 | $ 1,896 | ||

| 15 yr fixed mortgage | 5.750% | 0 | 5.800% | $ 300,000.00 | $ 2,491 | ||

| 30 Yr fixed FHA mtg | 6.125% | 0.25 | 6.975% | $ 300,000.00 | $ 1,823 | ||

| 30 Yr fixed VA mtg | 5.990% | 0 | 6.420% | $ 300,000.00 | $ 1,797 | ||

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||||

| 30 yr fixed mortgage | 6.500% | 0.5 | 6.676% | $1,200,000.00 | $ 7,585 | ||

| 15 yr fixed mortgage | 6.750% | 1 | 6.839% | $1,200,000.00 | $ 10,619 | ||

| 5/6 ARM | 6.625% | 1 | 6.759% | $1,200,000.00 | $ 7,684 | ||

| 10/6 ARM | 6.875% | 1 | 6.955% | $1,200,000.00 | $ 7,883 | ||

| Rates subject to change without notice. | |||||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (780+ fico, owner occupied SFR with 75% loan to value ratio or less and $200,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||||