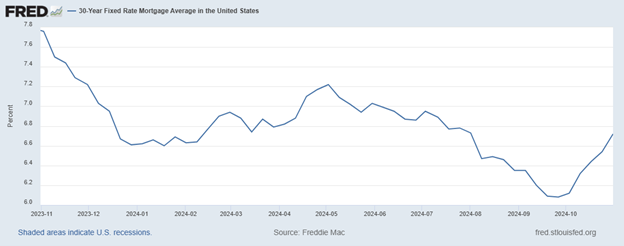

A funny thing happened on the path to lower interest rates. They took a turn and jogged higher!

This chart of 30yr fixed mortgage rates looks back a year. That low point was September 18th, before the FOMC made their cut to the Federal Funds Rate, which is the overnight rate at which banks can lend to each other. It has very little to do, directly, with mortgage rates.

But don’t fret. Nothing moves in a straight line. Fundamentally, there’s not much different economically speaking now, than what we saw leading up to the middle of September’s Federal Open Market Committee meeting, announcement, and press conference. That is, inflation appears to be cooling. Employment seems to be softening, but not cratering, and the economy as a whole seems to be holding up reasonably well.

The Fed’s cut to the federal funds rate had been telegraphed and priced into the market for a while before it actually happened, as I outlined in my last newsletter.

So why did rates rise so much, so quickly, since then? The short answer is, that’s what investors in Mortgage Backed Securities (MBS) demanded for their return on investment. That’s it. It’s investors who drive mortgage rates. They’re parking funds into pools of MBS, and they want a certain return on that investment, relative to their other investment vehicles.

Mortgage Backed Securities are massive pools of mortgages that are comparable to buying any other type of bond. They offer a fixed rate of return, at relatively low risk, for a medium duration, with good liquidity, so investors can get in and out easily. In general, “investors” in MBS are large, institutional investors or sovereign wealth funds, not individuals like you and me.

On a simplistic level, you could put your money into US Treasuries, say the 10yr Treasury, and currently get a return of about 4%, with as little risk as possible, since you’ve got the full faith and credit of the US backing those payments.

You could put your money into equities, which obviously have more risk, but can offer a greater return. Or maybe you put your money into Mortgage Backed Securities, and get a return somewhere between the two. And, although they’re theoretically a 30yr security, due to repayment speeds, they’re more akin to 5-, 7- or 10-year-ish terms, which is why the yield on the 10yr US Treasury is a reasonable proxy for watching market movement of MBS and thus mortgage rates.

All things being equal, if the economy is on solid footing, and corporate earnings are strong, and equities are returning nicely, that’s going to hurt bond prices, pushing their yields higher as they compete for those dollars. The same thing happens in reverse. If the economy is doing poorly, corporations are suffering, and their share prices are declining, then money may flow into bonds and Mortgage Backed Securities.

Right now, the economy seems to be chugging along, with inflationary pressures receding, employment remaining solid, but cooling, and everything seems right on the economic horizon.

Last Thursday we got the most recent Personal Consumption Expenditures Index, which is the Fed’s favorite measure of inflation. It came in at a 2.1% year over year increase, which was the smallest increase since February of 2021, and continued the downward trend for the year.

Friday’s jobs report was a significant miss, but with the hurricanes in Florida, there may be some noise in those figures that will soften over the next month or two.

Meanwhile, we have two other events that might move markets, with tomorrow’s election, followed by the FOMC’s next meeting starting Wednesday with their adjournment, policy statement and press conference Thursday, November 7.

I feel all of those may be non-events, regardless of who wins the elections, and whatever the Fed does or does not do.

It’s again presumed they’re going to cut the Federal Funds Rate by .25%. But, as you hear me say all the time, predicting a data point is one thing, and predicting the markets’ reaction to it is entirely another.

In essence, the expectation is that we’re through the height of the rate cycle, with the worst of inflation behind us. As that unfolds, if the economy continues cooling, then mortgage rates should continue drifting lower. But again, nothing moves in a straight line.

That’s why we, myself and my team at EZ Mortgages, try to advise you accordingly. Sometimes windows of opportunity to lock in your rate open and shut quickly. Sometimes they stay open for days, weeks, or even months. Our job is to read the tea leaves, inform you about your options and choices, so you can make an educated and informed decision that best fits your needs. That’s true whether you’re buying a home or refinancing an existing loan.

It’s just math along with some educated guesswork. And, we do our best to outline the math behind your best options, whether you’re buying or refinancing, and arm you with what we see as opportunities or pitfalls that may be on the horizon. Ultimately, if you’re buying a home, it’s about the right home that fits your needs and budget.

And if you miss a good window with interest rates? Usually, it’s not a permanent loss. If you look back just a year ago, when rates were at their highest point in 20+ years, people who financed their homes then have already been able to cost-effectively refinance. I think those opportunities will continue to present themselves.

With that, here’s your snapshot of where rates started this week. Call or email if you, your family or friends have any questions or would like to discuss refinancing, or buying a home. Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment | ||

| 30 yr fixed mortgage | 6.625% | 0 | 6.675% | $300,000.00 | $ 1,921 | ||

| 15 yr fixed mortgage | 6.125% | 0 | 6.175% | $300,000.00 | $ 2,552 | ||

| 30 Yr fixed FHA mtg | 6.125% | 0.25 | 6.289% | $300,000.00 | $ 1,823 | ||

| 30 Yr fixed VA mtg | 5.990% | 1 | 6.310% | $300,000.00 | $ 1,797 | ||

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||||

| 30 yr fixed mortgage | 6.875% | 1 | 6.955% | $1,200,000.00 | $ 7,883 | ||

| 15 yr fixed mortgage | 6.750% | 1 | 6.839% | $1,200,000.00 | $ 10,619 | ||

| 5/6 ARM | 6.625% | 1 | 6.759% | $1,200,000.00 | $ 7,684 | ||

| 10/6 ARM | 6.875% | 1 | 6.955% | $1,200,000.00 | $ 7,883 | ||

| Rates subject to change without notice. | |||||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (780+ fico, owner occupied SFR with 75% loan to value ratio or less and $200,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||||