There’s a recession coming.

That’s the easy call to make. The harder part is calling when it will arrive.

Most economic pundits and analysts are saying we’ll see the next recession in 2019 or 2020. That’s a pretty broad range. My personal best guess is a bit broader still, ranging anywhere from say six months, to maybe as long as 36 months out. Although I do think it’ll be on the closer end of that spectrum, there’s no way anyone can know with certainty. Even the official arbiters of recessions, the National Bureau of Economic Research (NBER) only put firm dates on them after they’ve come and gone.

The common definition of a recession is when GDP (Gross Domestic Product) sees negative growth for two consecutive quarters. Although, the NBER does include a number of other metrics in how they determine when the US economy has been through a recession (http://www.nber.org/cycles/recessions_faq.html) and they don’t “require” two consecutive quarters of negative growth.

Regardless of what defines a recession, however, it’s important to remember that recessions have always been a part of the economic cycle. Their severity will vary, but in many ways, they’re a healthy part of the cycle, cleaning out excesses in certain areas, and allowing new opportunities for growth to blossom.

But, knowing we’ve been through a recession after the fact is less helpful than planning for one before it happens, despite the difficulty in knowing the timing of when the next recession may hit.

Furthermore, in many cases, the “planning” for a recession may not really mean doing much differently with your finances, other than buckling down, and if possible, looking for, and being ready to seize new opportunities that may arise.

In my lifetime, for example, I’ve been through seven recessions. But, in honesty, the only one I really saw impact anyone directly was the Great Recession of 10 years ago (not to say the other six didn’t impact people, but it wasn’t as nearly wide-spread). And, although at least one guy I read (John Mauldin) thinks we’re headed for a catastrophe that’ll make the Great Recession look like child’s play – he calls it The Great Reset – he’s the first to admit, that could be ten or twenty or thirty years down the road. And in the meantime, we’re likely to see several other recessions come and go, along with new economic expansions, and great opportunities, as well.

That said, here are some key metrics to consider as potential leading indicators that may provide some clues about the timing for our next recession.

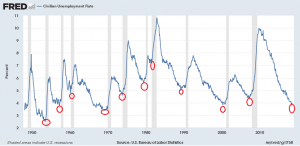

My favorite is the unemployment rate:

As you can see, pretty much without fail for the last 70 or so years, there’s a recession not far after the unemployment rate hits a cycle low.

According to the St. Louis Federal Reserve’s Economic Research Team, the average lag from the unemployment rate trough to the next recession is about 9 months (https://research.stlouisfed.org/publications/economic-synopses/2018/06/01/recession-signals-the-yield-curve-vs-unemployment-rate-troughs/).

We obviously don’t yet know if May’s 3.8% unemployment rate is the trough for this cycle (it was 4% in June and 3.9% in today’s report for August), but I think we can safely say it’s closer to the bottom than the top, right?

So, if that does turn out to be the trough, and the average span between that trough and the next recession holds (granted, those are two decent IF’s) we’d be looking at a recession starting sometime around the spring or early summer of 2019. That does sort of fit with my “gut” read of saying we may see bigger signs of our economy rolling over into recession territory, about six months from now.

Another favored indicator of impending recession is the Yield Curve (the gap between short term and long-term interest rates) – or rather the inversion of the Yield. The Yield Curve between the 2yr and 10yr treasury yield is at 24 basis points (.24%) and currently sits at its lowest level in years. Going all the way out to the 30yr only earns an additional 14 basis points. That’s a narrow spread between the risk of holding a bond for 2yrs and 30yrs. A lot can happen in 30yrs.

Recently, however, some economists wonder whether the yield curve inversion is as significant an indicator as it has been historically. But, even looking historically, and comparing yield curve inversion to the cycle low unemployment rate, the latter is a more accurate predictor than the former, according to the St. Louis Fed’s research cited above.

Lastly, the raising of the Federal Funds Rate is designed to cool economic expansions, keeping them from overheating. And, that overheating can lead to “irrational exuberance” ie: bubbles, which when burst, can make the next recession more painful (see The Great Recession). So, the Fed, trying to adhere to their mandate of maintaining price stability and moderating long-term interest rates, tries to smooth that curve. However, it’s rare that the Fed has been able to engineer soft economic landings during their monetary tightening cycles.

We’ve now seen seven increases to the Federal Funds Rate, since Dec. of 2015. It’s a foregone conclusion that at the next Federal Open Market Committee meeting on Sept. 26th, they’ll raise the Fed Funds Rate for the 8th time, by another .25%, pushing their target range from 2% to 2.25%. Today’s employment report and the increase in average hourly wages only heightened analyst’s certainty of the same. That will push Prime up to 5.25%. What that does to mortgage rates remains to be seen. They’ve been particularly sticky for the last six months, trading within a pretty narrow range. It’s possible that will remain the case as we move through the third quarter of 2018, as well. Having said that, today was a bad day in mortgage pricing, losing roughly .125% on the interest rate, for the same cost/credit as we had yesterday. In the big picture, that’s still not a large shift. Unless it’s your money. Then? You’re wondering why you can’t get that 4.25% rate for no points, and it’s now 4.375%.

What we’ll see as we roll through the latter part of this year, and into 2019 is still anyone’s guess. My guess, is that we’re likely going to remain in this same basic range for mortgage rates. But? That will all be driven by the economic cycle, and the demand for the returns that buying Mortgage Backed Securities provides investors, relative to the risk and return of the other available options.

As to when the next recession will hit, and how you can prepare for it? The best plan is to be secure in your job, income, and expenses, so if things turn a little south in your world, you’re able to ride through that. So, pay down debt, build savings, and otherwise, keep enjoying life.

If you’re flush with cash and secure in your income/employment? It may make sense to take some money off the table, and be ready to deploy it when opportunities arise. Sure, you may leave some money on the table doing that, getting out early when the markets are still rising, but at least half the battle of making it through recessions is not losing as much as the market may otherwise take. Getting out early, and missing the last bit of upward movement, may be better than being late, and participating in the first part of the next drop.

As you know, I’ll do my best to keep you posted as things evolve. But, I’m just a mortgage guy with an opinion, and my crystal ball is as murky as anyone’s, so, best to do your homework and forge the path that you think serves you best. As always, don’t hesitate to reach out so we can discuss how I can help in that process. If you, your friends, clients, or family have questions about buying or refinancing residential or commercial real estate, I’m always happy to be a resource.

Here’s where rates are as of this weekend.

Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment |

| 30 yr fixed mortgage | 4.375% | 0 | 4.425% | $ 300,000.00 | $ 1,498 |

| 15 yr fixed mortgage | 3.875% | 0 | 3.925% | $ 300,000.00 | $ 2,200 |

| 5/1 ARM | 3.875% | 0 | 4.125% | $ 300,000.00 | $ 1,411 |

| 10/1 ARM | 4.375% | 0 | 4.425% | $ 300,000.00 | $ 1,498 |

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||

| 30 yr fixed mortgage | 4.625% | 0 | 4.655% | $ 550,000.00 | $ 2,828 |

| 15 yr fixed mortgage | 4.500% | 0 | 4.530% | $ 550,000.00 | $ 4,207 |

| 5/1 ARM | 4.625% | 0 | 4.655% | $ 550,000.00 | $ 2,828 |

| 10/1 ARM | 4.625% | 0 | 4.655% | $ 550,000.00 | $ 2,828 |

| Rates subject to change without notice. | |||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (760+ fico, owner occupied SFR with 75% loan to value ratio or less and $250,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||

Eric Grathwol

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us