Happy New Year! I hope the College Football Playoff season is treating you and yours well…

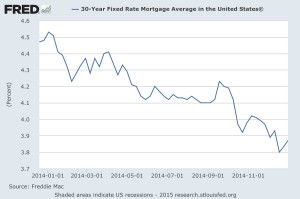

Last year, well, since May of 2013, really, I pretty much felt like we’d seen the floor in interest rates, and they’d be on a slow, steady plod higher. Although that was true for the rest of 2013, 2014 was a different story.

The only plodding they did was a slow, steady grind lower.

I’m still saying they’re headed up in 2015, as are most of the rest of the world’s people who watch these things, but…what do we know?

Not much, other than enjoy ‘em while we got ‘em!

I’m exercising my brevity, so that’s it for this update.

All the same factors I’ve written about before continue to be at play. In short. US seemingly on much better economic footing, and doing pretty well; Europe an ongoing concern; Russia an ongoing concern; China could have issues.

If the US is the leading edge of global economic growth, rates will rise. If exogenous shocks or foolish fiscal follies stunt that momentum in the US, we may drift through 2015 without much change. Or…possibly retesting prior lows set from the fall of 2012 through spring 2013 – although that would really surprise me.

Here’s what we’ve seen in the last 12 months:

I’ll do my best to keep you posted as we roll through 2015, too.

In the meantime, here are your rates ending this week. Please don’t hesitate to call or email if you, your friends, or family have questions about buying or refinancing residential or commercial real estate.

Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment | |

| 30 yr fixed mortgage | 3.750% | 0 | 3.800% | $ 300,000.00 | $ 1,389 | |

| 15 yr fixed mortgage | 3.000% | 0 | 3.050% | $ 300,000.00 | $ 2,072 | |

| 3/1 ARM | 3.375% | 0 | 3.425% | $ 300,000.00 | $ 1,326 | |

| 5/1 ARM | 3.250% | 0 | 3.300% | $ 300,000.00 | $ 1,306 | |

| Jumbo (ask me about Super Conforming limit, per your zip code) | ||||||

| 30 yr fixed mortgage | 4.250% | 0 | 4.280% | $ 550,000.00 | $ 2,706 | |

| 15 yr fixed mortgage | 4.375% | 0 | 4.405% | $ 550,000.00 | $ 4,172 | |

| 3/1 ARM | 3.625% | 0 | 3.655% | $ 550,000.00 | $ 2,508 | |

| 5/1 ARM | 3.375% | 0 | 3.405% | $ 550,000.00 | $ 2,432 | |

| Rates subject to change without notice. | ||||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (740+ fico, owner occupied SFR with 75% loan to value ratio or less), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | ||||||

Eric Grathwol

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us