What does retirement mean to you?

I consider myself pretty fortunate to really enjoy what I do, and make a reasonable living doing it. By some measures, a great living. Nevertheless, I’m not sure I’ll ever be able to “retire” in the true sense of the word.

Fortunately for me, I can do my work just as easily from a beach in Mexico, or a mountain retreat with fresh tracks out my door, as I can from my desk right now. Give me a phone and my laptop, and I’m at your service.

As one of my good friends and partner in a Sacramento law firm has now immortalized in their halls “Retire? Ha. I can do this ‘til I’m dead.” He was joking, making a flippant remark, but it stuck. Because it’s true.

My Uncle, who’s been an attorney for longer than I’ve been alive, still practices. Full time. I think he’s 74 now. I don’t know that he needs to, but he likes to. He worries about his clients. And, I believe he feels fulfillment in his work. He can do that, because he works with his mind, which, fortunately, is still functioning quite well.

Another good friend of mine is an ER Doc. We’re the same age. I don’t know how he does it. His shifts are often 24-48hrs on. Then he’s off for a few days. Then back on. Sometimes, he’s got to do those back to back to back, for whatever reason. That’s grueling. Can he do that at 70? Even at 60? He sure hopes he won’t have to.

On the other end of the spectrum, I have clients – they just emailed me after my last newsletter, in fact – letting me know they cashed out of their home in Boulder Creek, CA. Moved to Belize. They built a nice little home, with a garage and a casita/guest house, about a quarter mile from the beach. $215,000 construction cost. Annual property taxes of $15/yr. They have enough saved, and a small pension, that they can likely live out their lives that way. That sounds good to me!

But I bring this up because I’ve been thinking about the US employment picture. You know. Jobs. And, our demographics, and how they may impact that employment picture, and what that means to our economy, and interest rates.

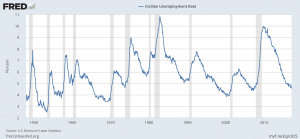

With today’s employment report, we learned that the official unemployment rate is at 4.5%, which is generally considered “full employment.” Even the U-6 unemployment level (which includes those working part time when they want full time work, and the marginally attached workers, in addition to the unemployed) is at 8.9%, a level not seen since December of 2007, on the precipice of the Great Recession.

And yet, despite those relatively robust numbers, we still have a lot of angst about people not making enough to get by, let alone retire. The debate over minimum wage and “living wages” is ongoing.

We hear about 20-somethings still (or again) living with their parents, whether for economic, or other reasons. My generation is facing “the squeeze” where some are not only raising children, and putting them through college, but also facing caring for our aging parents. These are in many ways, unprecedented times.

As my anecdote above illustrates, there are a whole lot of Baby Boomers who are still choosing to work, well after what is allegedly “retirement age.” Some, because they can, and want to. But, for many of them, they don’t have the option to retire. As people do, some are aging more, or less gracefully than others.

And, that may be the crux of the challenge we’re facing now. Demographics.

We’ve seen two forces at work in our employment picture that we’ve never seen before:

First, people can, and are choosing to work well into what would have been their “retirement years”. Whether for economic reasons (they need to) or for personal reasons (they like to, they can, etc.) doesn’t really matter.

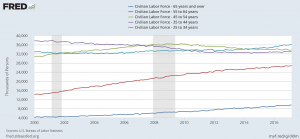

The number of workers aged 65+ has risen from roughly four million in 2000 to over nine million now. On top of that, the number of workers aged 55-64 rose from roughly 14 million in 2000 to over 26 million now. You’ll see the other cohorts, aged 25-54, remained relatively flat during that time, as seen in the chart below:

What impact does that have on our society and labor force?

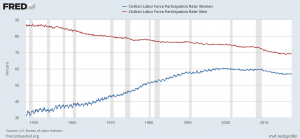

Another development that our economy is adjusting to is that women continue comprising a larger percentage of our workforce, and the male labor force participation rate is declining:

To be clear, the fact that we have an older workforce than ever before, and that there are more women working than ever before are not bad things. But, they are different. Just like the Model T replaced the horse and carriage, and the ice box was replaced by refrigeration, change happens. But, those inflection points can be painful, as economies and societies adjust to their evolving realities.

One of the chief complaints of our economic malaise has been that although we have been in one of the longest and strongest recoveries in terms of job creation in our history, and seem to be at “full employment” overall wage gains have been relatively anemic. Is that in part a result of the wage gap between men and women? Is it because as our economy has evolved, technology has displaced human labor, depressing wages? Will this begin to change, now that we’re allegedly at full employment, so workers can begin demanding higher wages?

Or, are forces conspiring in a deflationary trend, as Baby Boomers – regardless of their working longer than anyone has before – begin retiring, or dying, in either case, not consuming or spending as much, and also opening jobs for younger workers who can be paid significantly less? And, as technology continues accelerating, will more workers be displaced? Uber displaced Taxi drivers. Whose jobs will self-driving vehicles take? It could be a lot of people.

So, as we sit here, with mortgage rates and US Treasury yields still at historic lows, even as our economy seems to be on better footing, will we actually see a level of economic growth that drives interest rates markedly higher?

I’ve no idea. I sure didn’t think we’d see nearly a decade of ridiculously low interest rates. But, here we are. I don’t think the Japanese thought they’d see about thirty years of ridiculously low interest rates either, which they’re still trying to escape.

And, are higher interest rates part and parcel of economic growth and prosperity? After all, interest rates were at their zenith in the 1970s and early 1980s, when most people were not very happy with economic growth in America. It wasn’t until interest rates began falling that the US economy really picked up steam (and Baby Boomers blossomed into the workforce, as well). Has that steam run out? Are demographics and our evolving technology and labor force to blame?

This is the stuff I think about. Then, as people on Capitol Hill clamor for more jobs, and higher paying jobs, and that the unemployment rate, whether U-3 (the standard metric) or U-6 (the more comprehensive one) are still too high, I think of this:

I’m no economist, but it seems to me that each time we reach a cycle low in the unemployment rate, a recession isn’t too far behind.

I don’t know if the former assures the latter, or not. And, although recessions are an ever-present reality in any economy, and they serve a purpose of cleaning out excess, and allowing for sort of a “reset” it may be constructive to be careful what we wish for when it comes to driving unemployment lower. The next recession may be more surprising than the last.

In the meantime, I’ll do my best to keep you posted as we roll on through this year, and beyond. Please don’t hesitate to call or email if you, your friends, clients, or family have questions about buying or refinancing residential or commercial real estate.

Here’s how our rates ended this week.

Cheers!

E

| Conforming | Rates | Points | APR | Loan Amt | Payment |

| 30 yr fixed mortgage | 3.990% | 0 | 4.040% | $ 300,000.00 | $ 1,431 |

| 15 yr fixed mortgage | 3.250% | 0 | 3.300% | $ 300,000.00 | $ 2,108 |

| 3/1 ARM | 4.500% | 0.5 | 4.750% | $ 300,000.00 | $ 1,520 |

| 5/1 ARM | 3.125% | 0 | 3.175% | $ 300,000.00 | $ 1,285 |

| Jumbo (ask me about Super Conforming limit, per your zip code) | |||||

| 30 yr fixed mortgage | 4.375% | 0 | 4.405% | $ 550,000.00 | $ 2,746 |

| 15 yr fixed mortgage | 4.000% | 0 | 4.030% | $ 550,000.00 | $ 4,068 |

| 3/1 ARM | 4.000% | 0 | 4.030% | $ 550,000.00 | $ 2,626 |

| 5/1 ARM | 3.625% | 0 | 3.655% | $ 550,000.00 | $ 2,508 |

| Rates subject to change without notice. | |||||

| Please keep in mind, these rates and statistics are for informational purposes only to give you a sense of market movement and my opinion as to why. Although these rates exist today, based on certain qualifying characteristics (760+ fico, owner occupied SFR with 75% loan to value ratio or less and $250,000+ loan amount), your scenario may allow for lower or higher interest rates. Licensed by the CA Dept of Real Estate, #01760965. NMLS: 239756. Equal Opportunity Housing Lender. If you’d like to be removed from this list, please reply with REMOVE in the subject line. You can also use this link, mailto:eric@ezmortgages.us and add REMOVE to the subject line. To add someone who would appreciate this information, send me their email with SUBSCRIBE as subject. | |||||

Eric Grathwol

Broker

EZ Mortgages, Inc.

4535 Missouri Flat Rd. Ste. 2E

Placerville, CA 95667

Office: 530-303-3643

Cell: 916-223-4235

Fax: 530-237-5800

NMLS: 239756

www.ezmortgages.us